Our team has done some comprehensive analysis, digging through the information available on Best Weekend Payday Loans: Quick And Easy Financial Solutions in order to put together this guide. This should help readers make an informed decision when they need fast cash on the weekend.

Key differences or Key takeaways

Here is a table summarizing the key differences between weekday and weekend payday loans:

| Feature | Weekday Payday Loans | Weekend Payday Loans |

|---|---|---|

| Availability | Monday-Friday | 24/7 |

| Interest rates | Typically higher than weekend payday loans | Typically lower than weekday payday loans |

| Fees | May be higher than weekend payday loans | May be lower than weekend payday loans |

| Repayment terms | Typically due on your next payday | Typically due on your next payday |

As you can see, there are some key differences between weekday and weekend payday loans. Weekend payday loans are typically more expensive than weekday payday loans, but they are also more convenient. If you need cash fast on the weekend, a weekend payday loan may be a good option for you.

Payday Mayday: How to Get Quick Cash When You Need It In 3 Easy Steps - Source www.hooplaloans.co.za

To be eligible for a weekend payday loan, you will typically need to meet the following requirements:

- Be at least 18 years old

- Have a valid ID

- Have a checking account

- Have a source of income

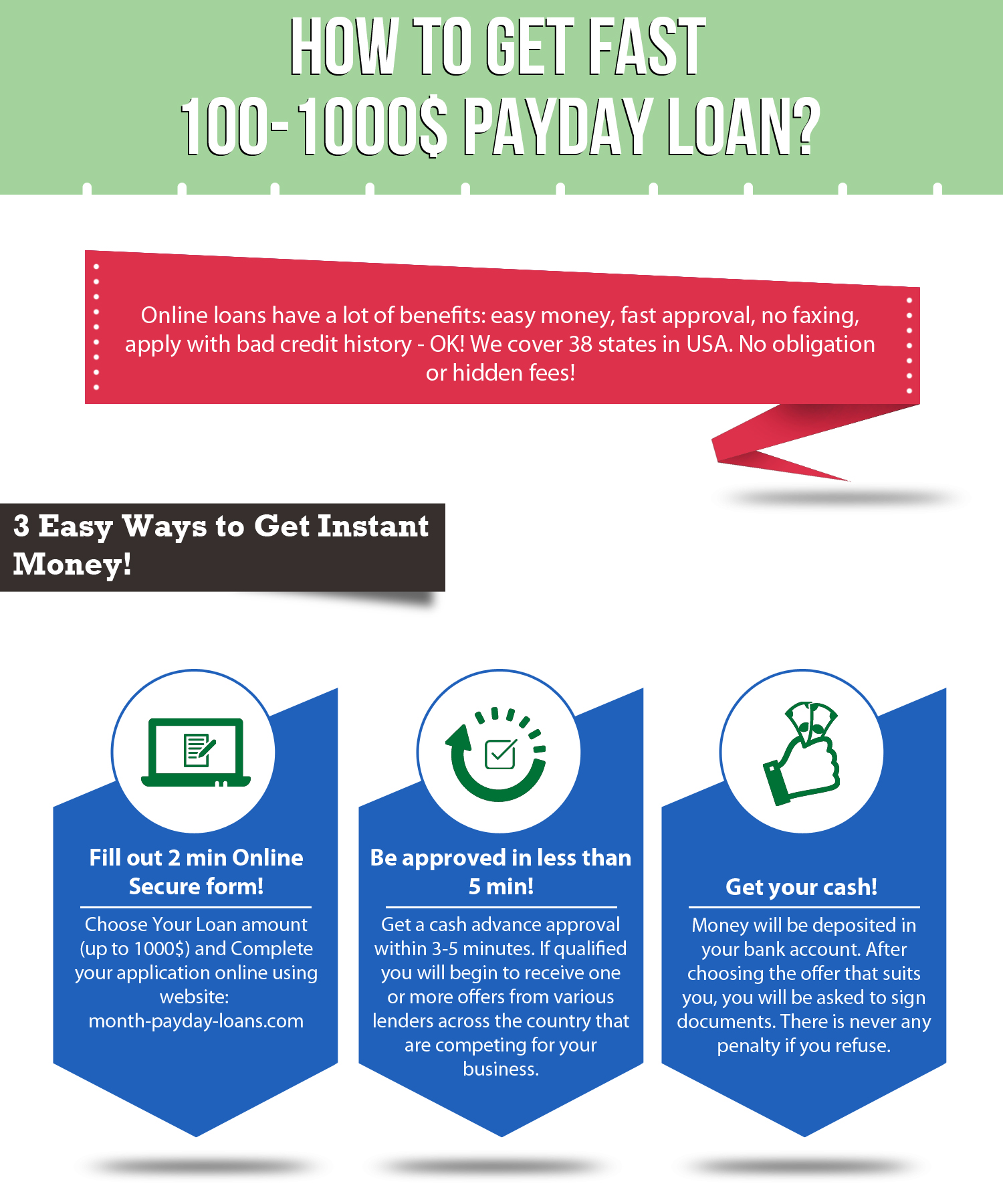

If you meet these requirements, you can apply for a weekend payday loan online or at a local store. The application process is quick and easy, and you can usually get approved for a loan within minutes.

Once you are approved for a weekend payday loan, the money will be deposited into your checking account. You can then use the money to cover any unexpected expenses that come up over the weekend.

FAQ

This section addresses frequently asked questions and provides informative answers to assist with understanding the services provided by "Best Weekend Payday Loans."

Payday Loans In South Africa - Loanspot.io South Africa - Source loanspot.io

Question 1: What are the eligibility requirements for obtaining a payday loan?

Payday loans typically have minimal eligibility criteria. Most lenders require applicants to be at least 18 years of age, possess a valid identification document and proof of income, and maintain an active checking account.

Question 2: How quickly can I receive the loan after approval?

The speed of loan disbursement varies depending on the lender's processing time and the chosen delivery method. Many lenders offer same-day or next-day funding if the application is approved before a specific cutoff time.

Question 3: What are the repayment terms for payday loans?

Payday loans typically have short repayment periods, often due on the borrower's next payday. The loan amount and interest charges are typically deducted from the borrower's checking account on the scheduled due date.

Question 4: What are the potential risks associated with payday loans?

Payday loans come with certain risks, such as high interest rates and fees, which can lead to a cycle of debt if not managed responsibly. It's crucial to carefully consider the loan terms and repayment plan before applying.

Question 5: What are the alternatives to payday loans?

There are alternative options to payday loans that may be more suitable depending on the situation. These include personal loans, credit union loans, or seeking financial assistance from non-profit organizations.

Question 6: What should I do if I am struggling to repay my payday loan?

If facing difficulties in repaying the payday loan, it's advisable to contact the lender promptly to discuss potential options, such as extending the repayment period or setting up a payment plan.

Remember, payday loans are a short-term financial solution and should be used judiciously. Understanding the terms and conditions, as well as the associated risks and alternatives, is vital before obtaining a payday loan.

For additional information, please refer to the subsequent sections of this article.

Weekend Payday Loan Tips

In a financial emergency, obtaining quick funding can be a challenge. Weekend payday loans offer a rapid and convenient solution, but it is crucial to approach them with caution. Here are some valuable tips to ensure a smooth and responsible borrowing experience.

Tip 1: Understand the Terms and Fees

Before applying, thoroughly review the loan agreement to comprehend the interest rates, fees, and repayment terms. Understand the total cost of borrowing and ensure you can comfortably meet the repayment schedule.

Tip 2: Check Your Eligibility

Eligibility criteria for weekend payday loans vary by lender. Typically, you must provide proof of income, a valid ID, and an active bank account. Ensure you meet these requirements before applying to avoid unnecessary delays or denials.

Tip 3: Use the Funds Responsibly

Weekend payday loans are designed to cover unexpected expenses. Avoid using them for discretionary spending or luxuries. Instead, allocate the funds towards essential bills, emergency repairs, or other pressing financial obligations.

Tip 4: Explore Alternatives

Consider exploring alternative funding options before opting for a weekend payday loan. Reach out to family or friends for assistance, or contact non-profit organizations that provide financial aid. These options may offer more flexible terms and lower interest rates.

Tip 5: Be Prepared for Repayment

Repayment deadlines for weekend payday loans are often short. Prepare a plan to ensure you have sufficient funds available on the due date to avoid penalties or negative credit impacts. Consider setting up automatic payments to streamline the process.

By following these tips, you can navigate the weekend payday loan process responsibly and effectively. Remember to approach borrowing with caution, fully understand the terms, and explore alternative options when possible. Also, consider seeking professional financial advice to make informed decisions about your finances.

For more information and guidance, refer to Best Weekend Payday Loans: Quick And Easy Financial Solutions.

Best Weekend Payday Loans: Quick And Easy Financial Solutions

Understanding the essential characteristics of weekend payday loans is crucial for individuals seeking quick financial assistance. These loans offer unique advantages that cater to urgent cash needs, making them an essential tool in addressing short-term financial emergencies.

Quick Payday Advance and easy treatment and also permission - metalstar - Source metalstar.co.uk

- Flexibility: Available on weekends, offering convenience in accessing funds when banks are closed.

- Speed: Quick approval and disbursement processes, providing rapid access to cash.

- Accessibility: Open to individuals with low credit scores, expanding loan availability.

- Simplicity: Straightforward application process with minimal documentation requirements.

- Transparency: Clear loan terms and repayment schedules, ensuring understanding of obligations.

- Reliability: Trusted and regulated lenders provide secure and dependable loan services.

These key aspects collectively contribute to the effectiveness of weekend payday loans in providing quick and easy financial solutions. They offer flexibility, speed, and accessibility, addressing urgent cash needs promptly and efficiently. Understanding these attributes empowers borrowers to make informed decisions and utilize these loans responsibly to navigate financial challenges effectively.

Best Weekend Payday Loans: Quick And Easy Financial Solutions

Payday loans are short-term, high-interest loans that can be a quick and easy way to get cash when you need it. However, it's important to understand the risks associated with payday loans before you take one out.

One of the biggest risks of payday loans is that they can be very expensive. The interest rates on payday loans are typically very high, and you may end up paying more in interest than you borrowed. For example, if you borrow $100 from a payday lender and the interest rate is 15%, you will pay $15 in interest if you repay the loan in two weeks. If you need more time to repay the loan, you will pay even more in interest.

Payday Loans (a Quick Fix or a Nightmare?) - Source goldenfs.org

Another risk of payday loans is that they can be difficult to repay. If you don't have the money to repay the loan when it's due, you may have to take out another payday loan to cover the cost. This can lead to a cycle of debt that can be difficult to break.

If you're considering taking out a payday loan, it's important to compare the costs and risks of different lenders. You should also make sure that you understand the terms of the loan before you sign anything.

Here are some tips for finding the best weekend payday loans:

By following these tips, you can find the best weekend payday loans and avoid the risks associated with these loans.

Conclusion

Payday loans can be a quick and easy way to get cash when you need it, but it's important to understand the risks before you take one out. The interest rates on payday loans are typically very high, and you may end up paying more in interest than you borrowed. If you don't have the money to repay the loan when it's due, you may have to take out another payday loan to cover the cost. This can lead to a cycle of debt that can be difficult to break.

If you're considering taking out a payday loan, it's important to compare the costs and risks of different lenders. You should also make sure that you understand the terms of the loan before you sign anything. Only borrow what you can afford to repay, and have a plan for how you will repay the loan.