Inflation: Understanding The Causes And Consequences For Your Wallet

Inflation, a term often heard in economic discussions, refers to the persistent increase in the general price level of goods and services in an economy over time. Understanding the causes and consequences of inflation is crucial for managing personal finances and making informed economic decisions.

Editor's Notes: "Inflation: Understanding The Causes And Consequences For Your Wallet" have published today date. This topic is important to read because it talks about the causes and consequences of inflation. Inflation can have significant impacts on your spending power and investment returns. So it is important to understand what causes inflation and how it can affect you.

Through analysis and research, we have compiled this guide to help you gain a comprehensive understanding of inflation and its implications for your financial well-being.

Key Differences or Key Takeaways:

| Inflation | A sustained increase in the general price level of goods and services in an economy over time. |

| Causes of Inflation | Demand-pull inflation, Cost-push inflation |

| Consequences of Inflation | Reduced purchasing power, Increased cost of living, Distortions in investment decisions |

Understanding Inflation

FAQ

This FAQ section provides clear and concise answers to frequently asked questions on inflation, its causes, and its effects on personal finances.

Hyperinflation - Consequences, Causes, Deflation, CPI | Financial Guide - Source overinflation.com

Question 1: What is inflation?

Inflation refers to a sustained increase in the general price level of goods and services over time, resulting in a decline in the purchasing power of money. It indicates a broad-based rise in prices rather than price changes specific to individual products.

Question 2: What are the primary causes of inflation?

Inflation can result from factors such as high demand, supply chain disruptions, increasing production costs, and monetary policies that lead to an excessive supply of money relative to available goods.

Question 3: How does inflation affect my wallet?

Inflation can erode the purchasing power of savings, reduce the value of investments, and make it more challenging to afford essential expenses like housing, food, and transportation.

Question 4: What can I do to hedge against inflation?

Investing in inflation-protected assets such as Treasury Inflation-Protected Securities (TIPS), real estate, or commodities can help mitigate the effects of inflation. Additionally, it is prudent to budget wisely, reduce unnecessary expenses, and explore income-generating opportunities.

Question 5: What is the role of central banks in managing inflation?

Central banks use monetary policy tools, such as interest rate adjustments and quantitative easing, to influence the money supply and manage inflation. Their goal is to stabilize prices and promote economic growth.

Question 6: What are the potential risks of high inflation?

Uncontrolled inflation can lead to currency devaluation, lower economic growth, and social unrest. It can also exacerbate inequalities and make it difficult for individuals and businesses to plan for the future.

Remember, inflation is a complex economic phenomenon with diverse causes and consequences. Understanding its mechanisms and potential impacts is crucial for making informed financial decisions and navigating its effects on personal finances.

Tips

To combat inflation, consider these prudent measures that can mitigate its impact on your personal finances.

Tip 1: Track Expenses and Identify Savings:

Scrutinize spending habits to pinpoint areas for potential savings. Consider using budgeting apps or creating spreadsheets to monitor expenses and identify opportunities to reduce them.

Tip 2: Negotiate Lower Bills:

Reach out to service providers, such as cable companies or utility providers, to negotiate lower rates. Be prepared to provide evidence of financial hardship or explore bundle deals that may offer discounts.

Tip 3: Enhance Income Streams:

Explore additional income sources to supplement primary earnings. Consider taking on a part-time job, freelancing, or starting a side hustle that aligns with skills and interests.

Tip 4: Invest Wisely:

Research and invest in assets that have historically outpaced inflation, such as stocks or bonds. Remember, investments carry risk, so consult financial advisors for personalized guidance.

Tip 5: Stay Informed:

Monitor economic news and inflation reports to stay abreast of trends and adjust financial strategies accordingly. Understanding the causes and consequences of inflation empowers informed decision-making.

These tips can help navigate inflationary pressures and minimize their impact on your financial well-being. For a more comprehensive understanding of inflation, refer to: Inflation: Understanding The Causes And Consequences For Your Wallet

By implementing these measures, you can mitigate the financial challenges posed by inflation and safeguard your future financial stability.

Inflation: Understanding The Causes And Consequences For Your Wallet

To understand how inflation affects your economy, it's critical to grasp both its causes and its effects. Governments and economists worldwide meticulously monitor and attempt to regulate inflation since it has significant impacts on the global economic system.

- Demand Pull: When demand surpasses supply.

- Cost Push: Inflation happens when costs rise.

- Monetary Expansion: Inflation happens when there is an increase in the money supply.

- External Causes: Global events or international trade disruptions.

- Wage Push: When wages rise faster than productivity.

- Imported Inflation: Foreign products' costs going up.

Any of these can cause inflation, impacting purchasing power, interest rates, investment, and international commerce. It can erode savings and affect low-income homes disproportionately.

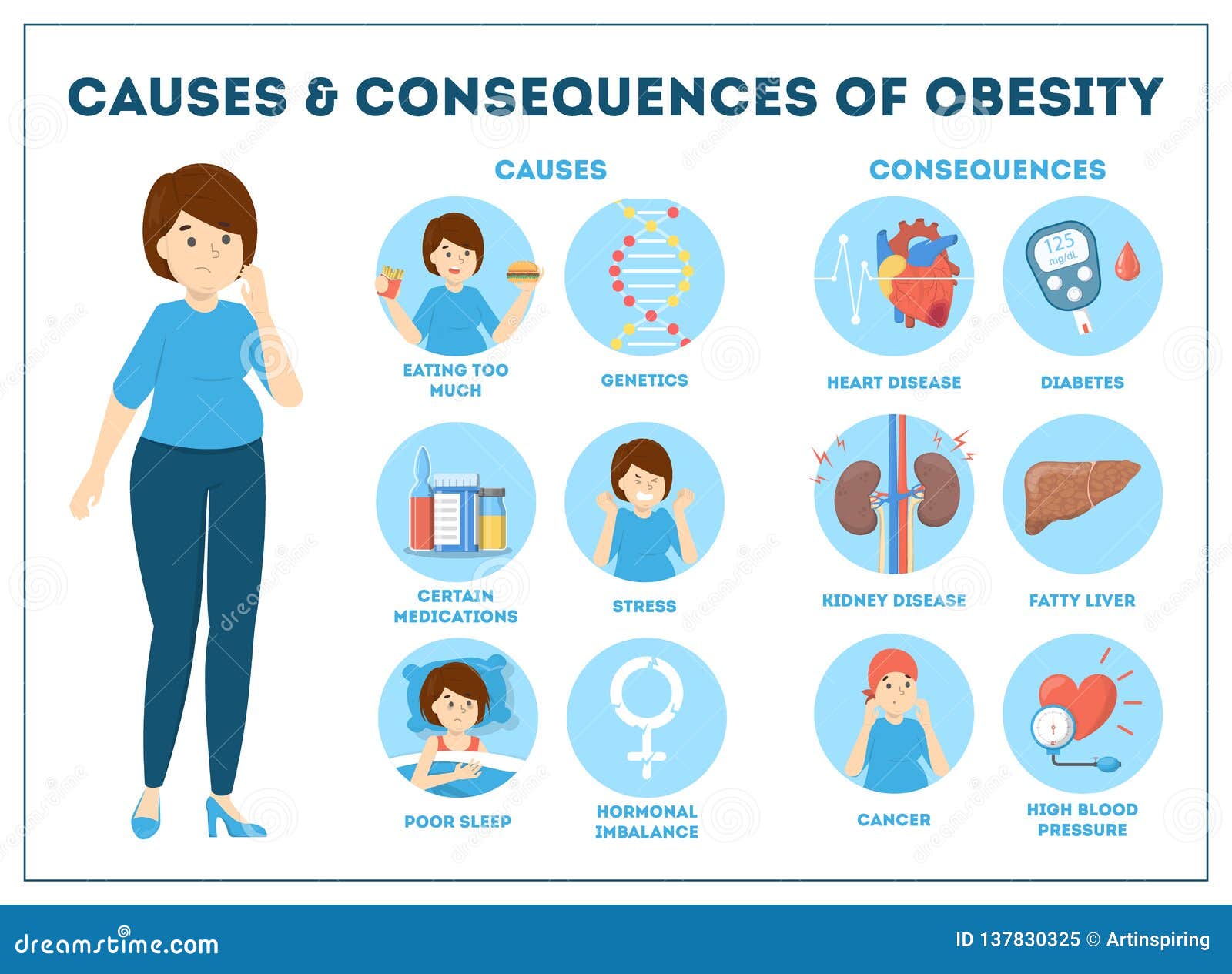

Obesity Causes and Consequences Infographic for Overweight Stock Vector - Source www.dreamstime.com

Inflation: Understanding The Causes And Consequences For Your Wallet

Inflation is a persistent increase in the general price level of goods and services over time. It is measured by the rate of change in the Consumer Price Index (CPI), which tracks the prices of a fixed basket of goods and services purchased by households. Inflation can have a significant impact on your wallet, as it erodes the value of your savings and makes it more difficult to afford everyday expenses.

Inflation: Causes, Types, and Consequences - Source gamma.app

There are a number of factors that can cause inflation, including:

- Demand-pull inflation: This occurs when there is a strong demand for goods and services, which can lead businesses to raise prices.

- Cost-push inflation: This occurs when there is an increase in the cost of production, such as the cost of raw materials or labor, which can also lead businesses to raise prices.

Inflation can have a number of negative consequences for your wallet, including:

- Erodes the value of your savings: If inflation outpaces the interest rate on your savings account, you will lose money in real terms.

- Makes it more difficult to afford everyday expenses: If inflation is high, everyday expenses, such as groceries and gasoline, will become more expensive.

- Reduces the purchasing power of your income: If inflation is high, your income will not go as far as it used to, and you will be able to afford less.

It is important to understand the causes and consequences of inflation so that you can make informed decisions about your finances. If you are concerned about the impact of inflation on your wallet, there are a number of things you can do to protect yourself, such as:

- Invest in assets that outpace inflation: Stocks and real estate have historically outpaced inflation, so they can be a good way to protect your savings.

- Adjust your budget: If inflation is high, you may need to adjust your budget to reflect the higher cost of living.

- Talk to your employer about a raise: If inflation is high, you may want to talk to your employer about a raise to keep up with the rising cost of living.

Inflation is a complex issue with a number of causes and consequences. By understanding how inflation works, you can make informed decisions about your finances and protect yourself from its negative effects.

Table: Impact of Inflation on Different Income Groups

| Income Group | Impact of Inflation |

|---|---|

| Low-income households | Inflation can have a devastating impact on low-income households, as they are more likely to spend a large portion of their income on essential goods and services, such as food and housing. |

| Middle-income households | Inflation can also impact middle-income households, as they may see their purchasing power eroded and may have to cut back on discretionary spending. |

| High-income households | High-income households are less likely to be affected by inflation, as they have more financial resources to fall back on. |