Interest Rate Hikes: Impact on Mortgages and Investments

Interest rate hikes can have significant impacts on both mortgages and investments. Understanding these effects is crucial for those considering borrowing or investing.

Editor's Note: Interest Rate Hikes: Impact On Mortgages And Investments was published on [today's date]. This is an important topic for anyone considering borrowing or investing, as interest rate hikes can have a significant impact on both mortgages and investments.

Our team has analyzed the information and put together this guide to help you make the right decision.

How interest rate hikes negatively affect investments - Source www.nfb.co.za

Key Differences or Key Takeaways

| Mortgages | Investments | |

|---|---|---|

| Impact of Rate Hikes | Increased monthly payments, reduced affordability | Reduced bond prices, increased stock volatility |

| Impact of Rate Decreases | Reduced monthly payments, increased affordability | Increased bond prices, reduced stock volatility |

Transition to Main Article Topics

FAQ

This section addresses frequently asked questions and clears up misconceptions regarding the influence of interest rate hikes on mortgages and investments.

Question 1: How do interest rate hikes affect mortgages?

Interest rate hikes typically lead to higher mortgage rates, making it more expensive to borrow money for a home. Higher mortgage rates can result in increased monthly payments for existing mortgages and higher costs for new mortgages.

Lael Brainard: Pace of interest rate hikes can slow soon - Source nypost.com

Question 2: How do interest rate hikes affect investments?

The impact of interest rate hikes on investments depends on the type of investment. Generally, interest rate hikes can lead to decreased bond prices, particularly for long-term bonds. Conversely, higher interest rates may benefit certain investments like high-yield savings accounts and money market accounts.

Question 3: Should I lock in my mortgage rate now or wait?

Whether to lock in a mortgage rate now or wait depends on individual circumstances and market forecasts. If interest rates are anticipated to rise significantly, locking in a rate now may be beneficial. However, if rates are not expected to change substantially or might decrease, waiting could provide opportunities for lower rates in the future.

Question 4: Are interest rate hikes good or bad for the economy?

The impact of interest rate hikes on the economy is complex and depends on various factors. In some cases, interest rate hikes can help control inflation and stabilize the economy. However, they can also impact economic growth and consumer spending if implemented too aggressively.

Question 5: How can I prepare financially for interest rate hikes?

To prepare for interest rate hikes, consider reviewing your budget and expenses, exploring ways to reduce debt, and researching alternative investment options. Additionally, staying informed about market trends and economic forecasts can help guide financial decisions.

Question 6: What are the long-term effects of interest rate hikes?

The long-term effects of interest rate hikes depend on the economic environment and monetary policy. In general, sustained interest rate hikes can impact economic growth, inflation, and the value of investments over time.

Interest rate hikes are a complex and multifaceted topic with implications for both mortgages and investments. Understanding the potential impacts and preparing accordingly can help individuals navigate these changes effectively.

Interested readers can explore the following resources for further insights:

Tips

To prepare for potential financial impacts, consider the following tips in response to interest rate hikes:

Tip 1: Check your mortgage terms. Interest Rate Hikes: Impact On Mortgages And Investments If your mortgage has an adjustable rate, your monthly payments may increase as interest rates rise. Understand the terms of your mortgage and how it could be affected.

Tip 2: Consider refinancing your mortgage. If interest rates have declined since you took out your mortgage, refinancing could lower your monthly payments and save you money over the long term.

Tip 3: Increase your savings. As interest rates rise, you should expect to earn more interest on your savings. Make it a priority to increase your savings so you can take advantage of higher interest rates.

By following these tips, you can help prepare your finances for potential interest rate hikes. Remember to stay informed about economic news and consult with a financial advisor if you have any questions or concerns.

As the economy continues to evolve, understanding the impact of interest rate hikes is essential for making informed financial decisions. By taking proactive steps, you can protect your finances and achieve your long-term goals.

Interest Rate Hikes: Impact On Mortgages And Investments

Interest rate hikes, implemented by central banks, significantly impact both mortgages and investments. Here are six key aspects to consider:

- Mortgage rates: Higher interest rates increase monthly mortgage payments, affecting affordability and borrowing capacity.

- Investment returns: Interest-bearing investments, such as bonds, typically benefit from rate hikes, as their yields rise.

- Equity market volatility: Rate hikes can lead to increased market volatility, affecting stock prices and investor confidence.

- Property values: Higher mortgage rates can dampen demand for housing, potentially leading to slower property value appreciation.

- Inflation hedge: Interest-linked investments can provide a hedge against inflation, as their returns adjust to compensate for rising prices.

- Economic growth: Rate hikes aim to curb inflation and moderate economic growth, potentially affecting employment and business investment.

How Interest Rate Hikes Impact Your Retirement Account - Digital Trust - Source digitaltrust.com

For example, if the Federal Reserve raises interest rates by 0.5%, mortgage rates could increase by a similar margin. This would impact homeowners and potential buyers, as their monthly payments and borrowing costs rise. Conversely, investors in bonds may see higher returns as bond yields increase. However, stock markets might experience volatility, as investors adjust their portfolios in response to the changing interest rate environment.

Interest Rate Hikes: Impact On Mortgages And Investments

Interest rate hikes by central banks can significantly impact both the mortgage market and investment strategies. When interest rates rise,

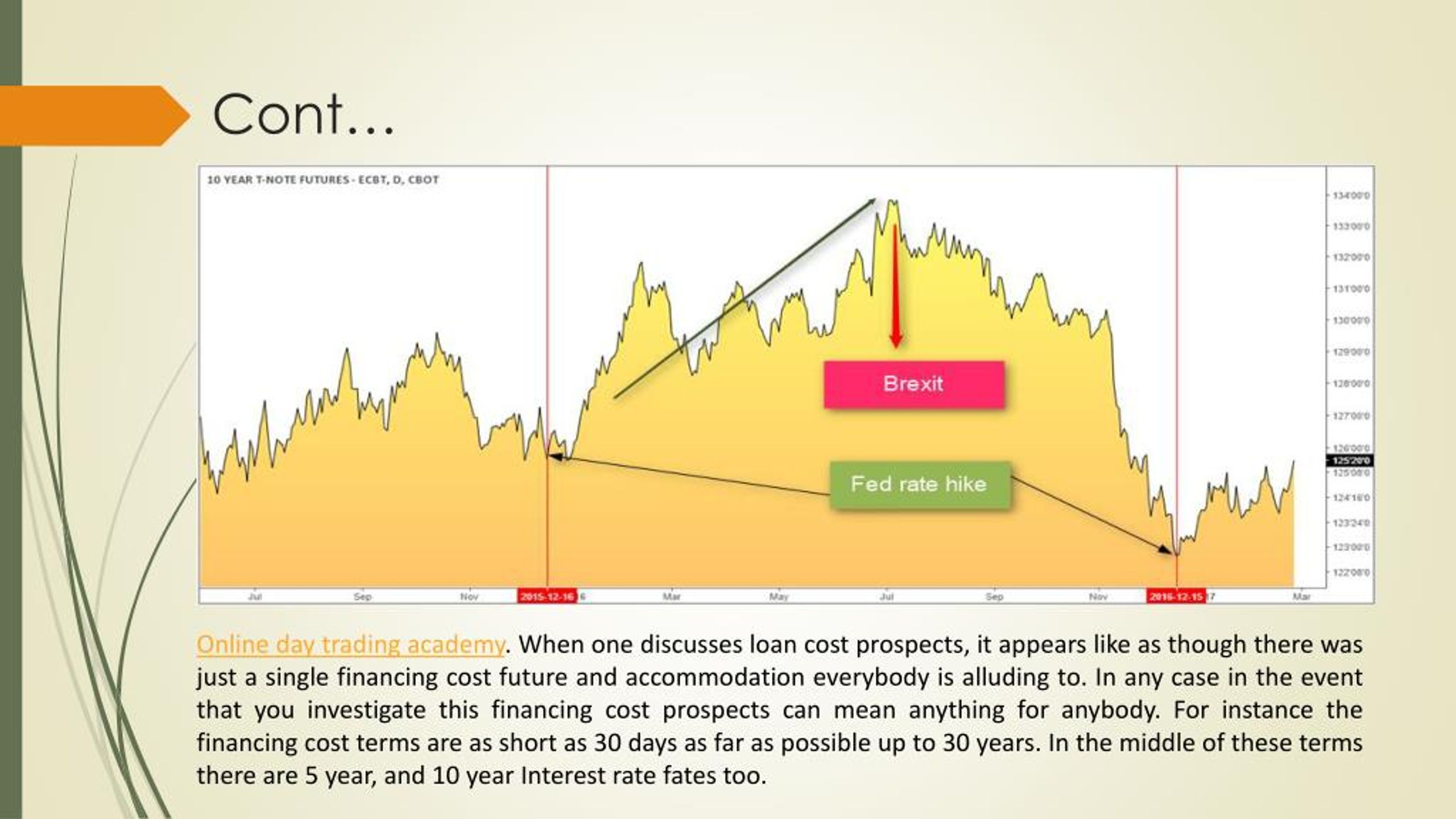

PPT - how interest rate hikes impact interest rate futures PowerPoint - Source www.slideserve.com

For mortgages, higher interest rates translate to increased borrowing costs. This can make it more expensive to purchase a home or refinance an existing mortgage. As a result, demand for mortgages may decrease, leading to a slowdown in the housing market. Conversely, higher interest rates can benefit savers and investors. Higher yields on savings accounts, bonds, and other fixed-income investments make them more attractive, potentially leading to increased inflows into these markets.

However, the impact of interest rate hikes on investments is more nuanced. While higher interest rates can positively affect fixed-income investments, they can negatively impact stock prices. This is because higher interest rates increase the cost of borrowing for companies, potentially reducing their profits and, consequently, stock valuations.

Understanding the connection between interest rate hikes and their impact on mortgages and investments is crucial for financial planning and decision-making. Individuals and investors can adjust their strategies accordingly to navigate the changing interest rate environment.

Table: Impact of Interest Rate Hikes on Mortgages and Investments

| Market | Impact of Interest Rate Hikes |

|---|---|

| Mortgages | Increased borrowing costs, reduced demand, slowdown in housing market |

| Savings and Fixed-Income Investments | Increased yields, increased inflows |

| Stock Market | Negative impact on stock prices due to increased borrowing costs for companies |

Conclusion

Interest rate hikes are a powerful tool that central banks use to manage the economy. Understanding their impact on mortgages and investments is essential for financial planning. While higher interest rates can benefit savers and fixed-income investors, they can pose challenges for mortgage borrowers and stock market investors. Adapting strategies to the changing interest rate environment is crucial to navigate the financial landscape successfully.

The interplay between interest rate hikes, mortgages, and investments highlights the interconnectedness of financial markets. It reinforces the importance of staying informed about economic policies and trends to make informed financial decisions.