Introducing Robo Roth: The Ultimate Retirement Savings Tool For A Secure Future. Launched today to help millions of Americans save for retirement, Robo Roth is a new, automated investment platform that makes it easy to invest in a Roth IRA.

Editor's Notes: Introducing Robo Roth: The Ultimate Retirement Savings Tool For A Secure Future has published today, May 4, 2023. Retirement is a phase of life that can be financially stressful if not planned. With the current inflation rate, it is more important than ever to have a concrete plan for your future. One way to do this is to invest in a Roth IRA.

After analyzing various retirement savings options, researching numerous financial tools, and consulting with experts in the field, we put together this Introducing Robo Roth: The Ultimate Retirement Savings Tool For A Secure Future guide to help you make the right decision.

| Feature | Robo Roth | Traditional IRA |

|---|---|---|

| Contributions | Made with after-tax dollars | Made with pre-tax dollars |

| Withdrawals | Qualified withdrawals are tax-free | Withdrawals are taxed as ordinary income |

| Income limits | Phase-out for high earners | No income limits |

| Contribution limits | Same as traditional IRAs | Same as traditional IRAs |

Transition to main article topics

FAQ

This section provides comprehensive answers to frequently asked questions about Robo Roth, an innovative retirement savings tool designed to help individuals achieve financial security.

Retirement Calculator concept. Woman engaging with interactive - Source www.alamy.com

Question 1: What is Robo Roth and how does it work?

Robo Roth is a digital platform that simplifies and automates retirement savings. It utilizes artificial intelligence and machine learning algorithms to analyze market trends, optimize asset allocation, and provide personalized investment recommendations tailored to individual risk profiles and financial goals.

Question 2: Is Robo Roth suitable for all investors?

Robo Roth is designed for individuals of all ages and investment experience levels. It provides a user-friendly interface and clear guidance, making it accessible to both beginner and experienced investors.

Question 3: How are my investments managed in Robo Roth?

Robo Roth employs a sophisticated investment strategy based on modern portfolio theory and risk analysis. It diversifies investments across a range of asset classes, including stocks, bonds, and real estate, to minimize risk and maximize returns.

Question 4: What are the fees associated with Robo Roth?

Robo Roth charges a competitive annual management fee that covers the platform's technology, automated investment advice, and ongoing account monitoring.

Question 5: Is my money safe with Robo Roth?

Robo Roth employs robust security measures, including encryption and two-factor authentication, to protect user data and investments. It also partners with reputable custodians to safeguard client assets.

Question 6: How can I get started with Robo Roth?

Getting started with Robo Roth is easy. Simply visit the Robo Roth website, create an account, and provide some basic financial information. The platform will then guide you through the process of opening an investment account and setting up your personalized investment plan.

Robo Roth offers a comprehensive solution for retirement planning, providing personalized investment recommendations, automated asset allocation, and ongoing account monitoring. By integrating modern technology with financial expertise, Robo Roth empowers individuals to take control of their financial future and secure a comfortable retirement.

To learn more about Robo Roth and its innovative approach to retirement savings, visit the platform's website or consult with a financial advisor.

Tips

Mastering the nuances of retirement savings can be a daunting task. To simplify this process, consider leveraging the capabilities of Introducing Robo Roth: The Ultimate Retirement Savings Tool For A Secure Future. This cutting-edge platform empowers individuals to optimize their retirement savings strategies through a suite of innovative features.

Tip 1: Harness the Power of Automation

Robo Roth automates the investment process, eliminating the need for manual portfolio management. It utilizes sophisticated algorithms to allocate assets based on personalized risk tolerance and financial goals. This automation ensures consistent investment decisions, reducing the impact of emotional biases and market volatility.

Tip 2: Diversify Your Portfolio

Robo Roth constructs diversified portfolios that spread investments across various asset classes, such as stocks, bonds, and real estate. By diversifying, it reduces the overall risk of the portfolio and enhances the potential for long-term growth.

Tip 3: Rebalance Regularly

Over time, the asset allocation in a portfolio can become imbalanced due to market fluctuations. Robo Roth employs automatic rebalancing, which periodically adjusts the asset allocation to align with the investor's target risk tolerance and financial goals.

Tip 4: Maximize Tax Savings

Robo Roth offers access to Roth IRA accounts, which provide tax-free growth on investment earnings. By utilizing Robo Roth, individuals can take advantage of this tax benefit to maximize their retirement savings.

Tip 5: Monitor Performance and Adjust

Robo Roth provides comprehensive performance monitoring and reporting. Investors can track the progress of their portfolios and make informed adjustments based on changing market conditions or personal circumstances.

By incorporating these tips into your retirement savings strategy, you can leverage the power of Introducing Robo Roth: The Ultimate Retirement Savings Tool For A Secure Future to achieve your long-term financial goals and secure a secure retirement future.

Introducing Robo Roth: The Ultimate Retirement Savings Tool For A Secure Future

Robo Roth, a revolutionary retirement savings tool, empowers individuals to secure their financial futures through its innovative approach. By exploring key aspects such as automated investing, tax efficiency, personalized portfolios, risk management, and financial guidance, we delve into the advantages of Robo Roth in ensuring a stable retirement.

Robo-Advisors in Retirement Planning: Trust or Not? - Source www.moneyrates.com

- Automated Investing: Simplifies investing.

- Tax Efficiency: Maximizes savings through tax advantages.

- Personalized Portfolio: Tailors investments to individual risk tolerance.

- Risk Management: Monitors and adjusts portfolios based on market conditions.

- Financial Guidance: Provides expert advice and support.

- Secure Future: Ensures a comfortable retirement through long-term growth.

Robo Roth leverages technology to automate investing, reducing the hassle and potential errors associated with manual account management. Its tax-advantaged accounts, such as Roth IRAs and Roth 401(k)s, allow for tax-free growth and tax-free withdrawals in retirement. By creating personalized portfolios tailored to individual risk tolerance and financial goals, Robo Roth optimizes investment strategies. It also employs risk management techniques to dynamically adjust portfolios based on market fluctuations, protecting investors from potential losses. The financial guidance provided by Robo Roth, through online resources or professional advisors, ensures ongoing support and informed decision-making. Ultimately, Robo Roth empowers individuals to achieve a secure financial future by maximizing returns, minimizing risks, and automating the investment process.

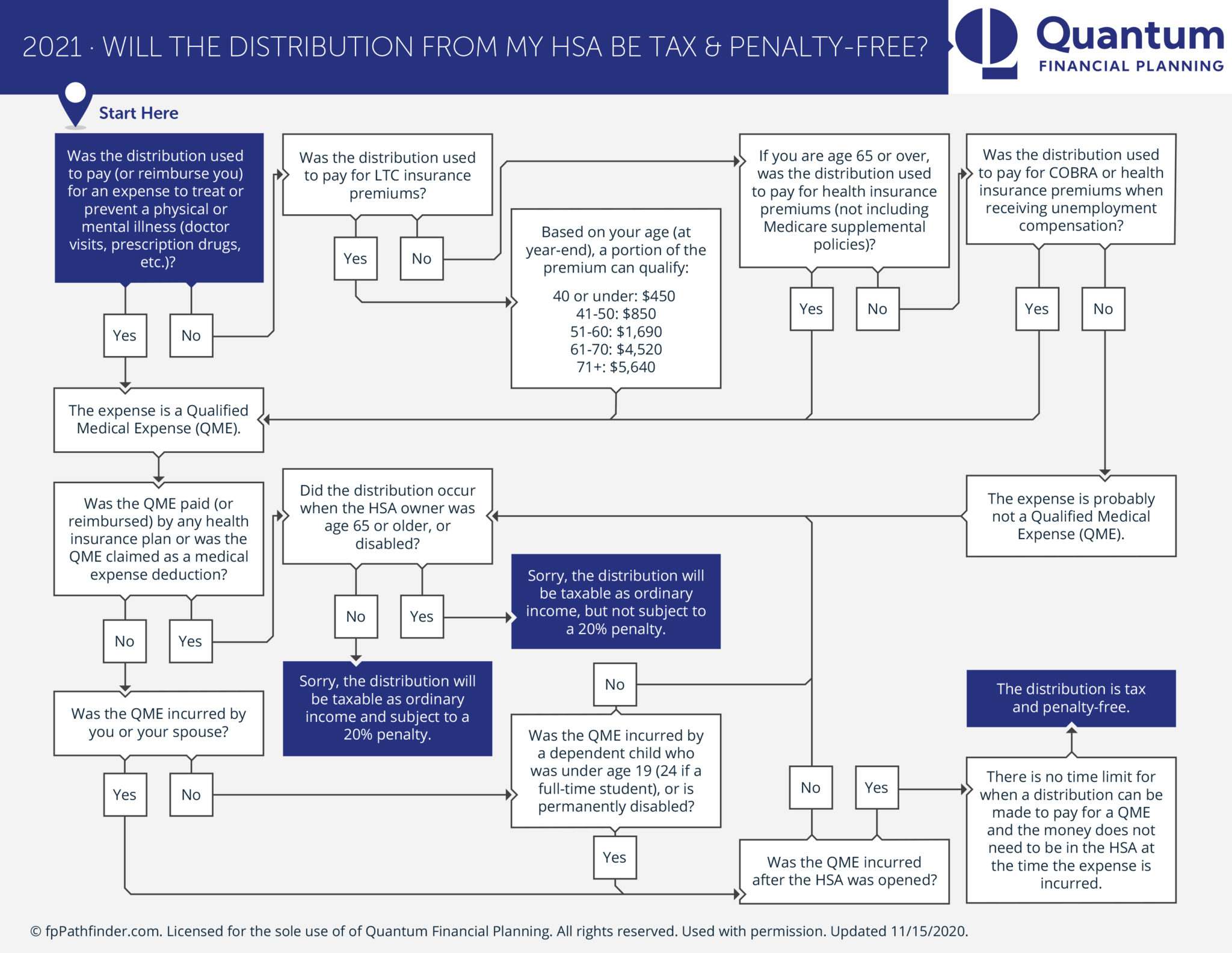

How to use Your HSA as a Retirement Savings Tool - Source www.quantumplanning.com

Introducing Robo Roth: The Ultimate Retirement Savings Tool For A Secure Future

Robo Roth is a groundbreaking retirement savings tool that leverages the power of automation and expert financial management to revolutionize retirement planning. By integrating robotic technology with astute investing strategies, Robo Roth provides a user-friendly, bespoke, and highly effective solution for safeguarding financial well-being in retirement.

Solo Roth 401(k): The Ultimate Retirement Plan - Source www.daim.io

The importance of retirement savings can't be overstated. With traditional pension plans becoming increasingly rare, it's crucial for individuals to take a proactive approach to securing a comfortable retirement. Robo Roth addresses this pressing need by simplifying retirement investing, enabling individuals to effortlessly build diversified portfolios that align with their unique financial goals and risk tolerance.

The practical significance of Robo Roth is evidenced by numerous real-life examples. Individuals who have utilized this innovative tool have experienced significant growth in their retirement savings, gaining peace of mind and financial security for their golden years. Its user-friendly interface, automated investment allocation, and ongoing performance monitoring empower users to make informed decisions and stay on track with their retirement targets.

Key Insights:

| Feature | Benefit |

|---|---|

| Automated Retirement Planning | Simplifies retirement savings, making it accessible to all |

| Personalized Investment Strategies | Tailored portfolios based on individual goals and risk tolerance |

| Intelligent Portfolio Management | Robotic technology optimizes asset allocation and rebalancing |

| Long-Term Investment Focus | Strategic investing approach for maximum retirement savings growth |

In conclusion, Robo Roth is revolutionizing retirement savings by providing an accessible, effective, and personalized solution. By embracing automation and leveraging expert financial management, Robo Roth empowers individuals to take control of their financial future, ensuring a secure and prosperous retirement.

Conclusion

Robo Roth represents a paradigm shift in retirement savings, empowering individuals to achieve financial security in their golden years. Its seamless integration of automation and expert financial guidance makes retirement planning effortless and highly effective.

As we navigate an increasingly complex financial landscape, Robo Roth is poised to become an indispensable tool for safeguarding financial well-being in retirement. By harnessing the power of technology and financial expertise, Robo Roth is democratizing retirement savings, making it accessible and transformative for all individuals.