| Key Differences | Key Takeaways |

|---|---|

| Consumers will have to pay more for vehicles. | This will lead to a decrease in demand for vehicles. |

| The economy will be negatively impacted. | This is because the tax hike will reduce consumer spending and investment. |

FAQ

To provide clarity on the impact of Sri Lanka's Vehicle Excise Tax (VET) hike, we have compiled a list of frequently asked questions (FAQs):

District Of Columbia Motor Vehicle Excise Tax Electrical - Mindy Nellie - Source deeannqjenifer.pages.dev

Question 1: What is the extent of the VET hike?

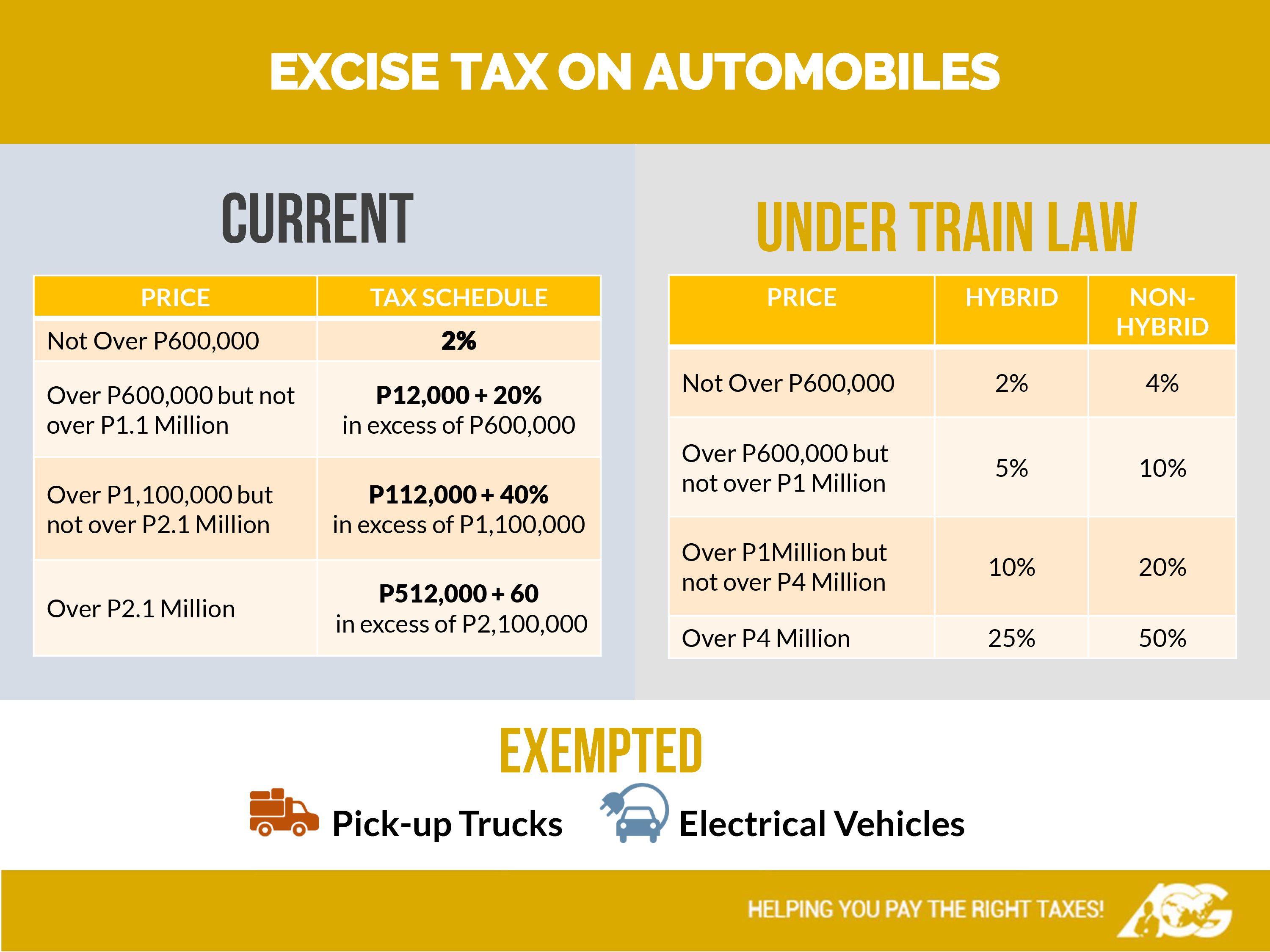

Answer: The new VET rates vary based on the vehicle's category, engine capacity, and age. On average, the tax hike ranges from 25% to 100% for different vehicle types.

Question 2: How will the VET hike impact consumers?

Answer: Consumers purchasing new vehicles will face higher upfront costs due to the increased VET. Additionally, the tax hike may lead to a rise in prices for used cars as dealers pass on the additional tax burden.

Question 3: What are the potential implications for the economy?

Answer: The VET hike could dampen the demand for new vehicles, impacting the automotive industry and related sectors. It may also contribute to inflationary pressures in the overall economy.

Question 4: Is the VET hike justified?

Answer: The government argues that the VET hike is necessary to generate additional revenue and support essential infrastructure projects. However, critics argue that it places an undue burden on consumers and stifles economic growth.

Question 5: Are there any exemptions or concessions available?

Answer: Certain categories of vehicles, such as electric and hybrid vehicles, may be eligible for reduced VET rates or exemptions. Additionally, individuals with disabilities or those engaged in essential services may qualify for concessions.

Question 6: What measures can consumers take to mitigate the impact of the VET hike?

Answer: Consumers can consider purchasing fuel-efficient vehicles, negotiating with dealers for discounts, or exploring alternative modes of transportation to reduce the financial burden of the increased VET.

In summary, the VET hike in Sri Lanka has raised concerns among consumers and economists alike. The full impact of the tax increase remains to be seen, but it is expected to have significant implications for the automotive industry and the broader economy.

Next: Analysis and Commentary on the VET Hike

Tips

The recent hike in Sri Lanka's Vehicle Excise Tax (VET) has had a significant impact on consumers and the economy. This article examines the effects of the tax increase and offers some tips on how to mitigate its impact.

Excise Inspector (Open) - Excise Department of Sri Lanka - Source lankajobs.lk

Tip 1: Consider the cost of ownership

VET is now a major factor to consider when purchasing a vehicle. Buyers should carefully assess the total cost of ownership, including the purchase price, running costs, and resale value, before making a decision.

Tip 2: Explore alternative transportation options

Rising vehicle costs may encourage people to consider alternatives. This could include public transportation, ridesharing, or even walking or biking. By reducing reliance on cars, individuals can minimize the impact of VET.

Tip 3: Research fuel-efficient vehicles

With fuel prices also on the rise, it's more important than ever to choose vehicles that are fuel-efficient. This can help reduce running costs and offset some of the impact of the VET.

Tip 4: Consider downsizing

Purchasing a smaller, more affordable vehicle can be a way to manage the costs associated with VET. Downsizing can also lead to savings on insurance, fuel, and maintenance.

Tip 5: Take advantage of tax breaks

In some cases, there may be tax breaks available for vehicles that meet certain criteria. For example, hybrid and electric vehicles often qualify for incentives. Researching these incentives can help reduce the overall cost of owning a vehicle.

By following these tips, consumers can mitigate the impact of the Vehicle Excise Tax hike and make informed decisions about their vehicle ownership. For a more comprehensive analysis of the situation, refer to the article Sri Lanka's Vehicle Excise Tax Hike: Impact On Consumers And The Economy.

Sri Lanka's Vehicle Excise Tax Hike: Impact On Consumers And The Economy

Sri Lanka's recent vehicle excise tax hike has far-reaching implications for consumers and the economy.

- Increased Vehicle Prices

- Reduced Consumer Spending

- Automotive Industry Slowdown

- Increased Transportation Costs

- Inflationary Pressures

- Negative Impact on Tourism

Consumers and businesses alike will bear the brunt of higher vehicle costs. This will lead to reduced consumer spending in other sectors, potentially slowing economic growth. The automotive industry, heavily reliant on tax-induced vehicle sales, will also face challenges. As transportation costs rise, it will have a knock-on effect on the prices of goods and services, contributing to inflation. Furthermore, the higher cost of imported vehicles could discourage tourism, affecting a key revenue source for Sri Lanka.

Sri Lanka's Vehicle Excise Tax Hike: Impact On Consumers And The Economy

Sri Lanka's government recently announced a significant hike in vehicle excise taxes, a move that has sent shockwaves through the country's automotive industry and consumers alike. The new tax rates, which came into effect on January 1, 2023, have been met with widespread criticism and concern.

Vehicle Excise Duty Car Tax - Pier Othilie - Source brunhildewviole.pages.dev

The impact of the tax hike is likely to be far-reaching, affecting both consumers and the economy as a whole. Consumers will face higher costs to purchase and own vehicles, which could lead to a decline in sales and a slowdown in the automotive sector. The tax hike could also have a negative impact on the economy, as it could reduce consumer spending and investment.

The government has defended the tax hike, arguing that it is necessary to raise revenue to fund public services and infrastructure projects. However, critics argue that the tax hike is regressive, meaning it will disproportionately impact low- and middle-income earners. They also argue that the tax hike will stifle economic growth and lead to job losses.

The impact of the tax hike is still unfolding, but it is clear that it will have a significant impact on consumers and the economy. It remains to be seen how the government will respond to the criticism and whether it will consider rolling back or revising the tax hike.

|---|---|

| Higher costs to purchase and own vehicles | Decline in sales and slowdown in automotive sector |

| Reduced consumer spending and investment | Negative impact on overall economic growth |

| Job losses in the automotive sector |

Conclusion

The Sri Lankan government's decision to hike vehicle excise taxes has been met with widespread criticism and concern. The tax hike is likely to have a significant impact on consumers and the economy as a whole. Consumers will face higher costs to purchase and own vehicles, which could lead to a decline in sales and a slowdown in the automotive sector. The tax hike could also have a negative impact on the economy, as it could reduce consumer spending and investment.

It is important to note that the tax hike is regressive, meaning it will disproportionately impact low- and middle-income earners. The tax hike could also lead to job losses in the automotive sector. The government should carefully consider the impact of the tax hike and consider rolling back or revising it.