When the U.S. housing market crashed in 2008, it caused a global financial crisis. The Big Short: How A Few Outsiders Took On The Banks And Won recounts the story of a few investors who bet against the mortgage market and made billions of dollars when the housing bubble burst.

The outsiders film hi-res stock photography and images - Alamy - Source www.alamy.com

Editors' Notes: "The Big Short: How A Few Outsiders Took On The Banks And Won" have published today date. But why does it matter? This book is a must-read for anyone who wants to understand the 2008 financial crisis and the role that the banks played in it.

We did the analysis, dug into the information, and put together this The Big Short: How A Few Outsiders Took On The Banks And Won guide to help you make the right decision.

Whether you're a seasoned investor or just starting out, this book is a valuable resource. It's a reminder that even the most complex financial instruments can be understood and that it's possible to make money even when the market is crashing.

Key differences or Key takeways:

| The Big Short: How A Few Outsiders Took On The Banks And Won | |

|---|---|

| Target audience | Investors, financial professionals, and anyone interested in the 2008 financial crisis |

| Key takeaways |

|

| Recommendation | A must-read for anyone who wants to understand the 2008 financial crisis and the role that the banks played in it. |

Transition to main article topics:

- The causes of the 2008 financial crisis

- The role of the banks in the crisis

- The investors who bet against the mortgage market

- The impact of the financial crisis on the global economy

FAQs

Here are the frequently asked questions about the book "The Big Short: How A Few Outsiders Took On The Banks And Won."

its no secret why outsiders won. : r/csgo - Source www.reddit.com

Question 1: What is "The Big Short" about?

The Big Short is a book written by Michael Lewis that tells the story of how a group of investors predicted the collapse of the housing market in 2008 and made billions of dollars by betting against subprime mortgages.

Question 2: Who are the main characters in "The Big Short"?

The main characters in The Big Short are Michael Burry, Steve Eisman, Greg Lippmann, and Ben Hockett. These four investors were among the few who realized that the housing market was a bubble and that it was about to burst.

Question 3: What is the significance of "The Big Short"?

The Big Short is significant because it provides a first-hand account of the events that led to the 2008 financial crisis. The book also highlights the role that greed and recklessness played in the collapse of the housing market.

Question 4: What are the key takeaways from "The Big Short"?

The key takeaways from The Big Short are that it is important to be skeptical of financial markets, to do your own research, and to be aware of the risks involved in investing.

Question 5: How has "The Big Short" been received?

The Big Short has been well-received by critics and readers alike. The book has been praised for its clear writing, its compelling characters, and its insights into the financial crisis.

Question 6: Is "The Big Short" worth reading?

Yes, The Big Short is worth reading. The book is a fascinating and informative account of the events that led to the 2008 financial crisis. It is also a valuable resource for anyone who wants to learn more about the financial markets.

In conclusion, The Big Short is a must-read for anyone who wants to understand the 2008 financial crisis. The book is well-written, informative, and thought-provoking. It is a valuable resource for anyone who wants to learn more about the financial markets.

Thank you for reading.

Tips

To unravel the complexities of the financial crisis, take cues from The Big Short: How A Few Outsiders Took On The Banks And Won, a book that unveils the story of investors who predicted and profited from the subprime mortgage collapse. The following tips distill essential lessons from their experience.

Tip 1: Embrace Skepticism

Question conventional wisdom. Analyze data critically and identify discrepancies that challenge accepted assumptions. This skepticism can lead to uncovering hidden risks and overlooked opportunities.

Tip 2: Seek Independent Perspectives

Avoid relying solely on mainstream sources. Engage with independent analysts and experts who provide alternative views and in-depth insights. Diverse perspectives foster a more comprehensive understanding of market dynamics.

Tip 3: Conduct Thorough Due Diligence

Assess investments meticulously before committing. Examine underlying assets, perform stress tests, and analyze risk factors. Thorough due diligence minimizes exposure to potential losses and increases the likelihood of successful investments.

Tip 4: Understand Leverage and Risk

Recognize the potential dangers of excessive leverage. Using borrowed funds to invest magnifies both potential gains and losses. Exercise caution and ensure that risk levels align with financial tolerance.

Tip 5: Learn from History

Study past financial crises to identify patterns and warning signs. History often repeats itself, and understanding previous events can enhance preparedness for future challenges.

Tip 6: Manage Emotions and Avoid Herd Mentality

Control emotions and resist the temptation to follow the crowd. Emotional decision-making can lead to poor investment choices. Maintain a level-headed approach and make decisions based on sound analysis.

By embracing these principles, investors can increase their financial literacy, make informed decisions, and navigate market complexities more effectively.

The Big Short: How A Few Outsiders Took On The Banks And Won

The Big Short, a book and subsequent film, chronicles the events leading up to the 2008 financial crisis and highlights the role of a few individuals who predicted and profited from the collapse of the housing market.

peach print: Book + Movie Review: The Outsiders by S.E. Hinton - Source peachprint.blogspot.com

- Subprime Mortgages: Risky loans given to borrowers with poor credit.

- Credit Default Swaps: Insurance contracts that protect against default on債券.

- Housing Bubble: A period of rapidly rising home prices, fueled by subprime lending.

- Financial Crisis: The 2008 collapse of the housing market and subsequent financial meltdown.

- Shorts: Bets that an asset's value will decline.

- Outsiders: Individuals who were not part of the mainstream financial system.

The key aspects discussed in this overview provide a comprehensive understanding of the complex events depicted in The Big Short. The subprime mortgage crisis, credit default swaps, and housing bubble were all contributing factors to the ultimate financial crisis. Amidst this turmoil, a group of outsiders, armed with unconventional strategies and insights, made bold bets against the housing market and emerged as unlikely heroes. Their story highlights the importance of critical thinking, risk-taking, and challenging established norms, even in highly complex and opaque financial systems.

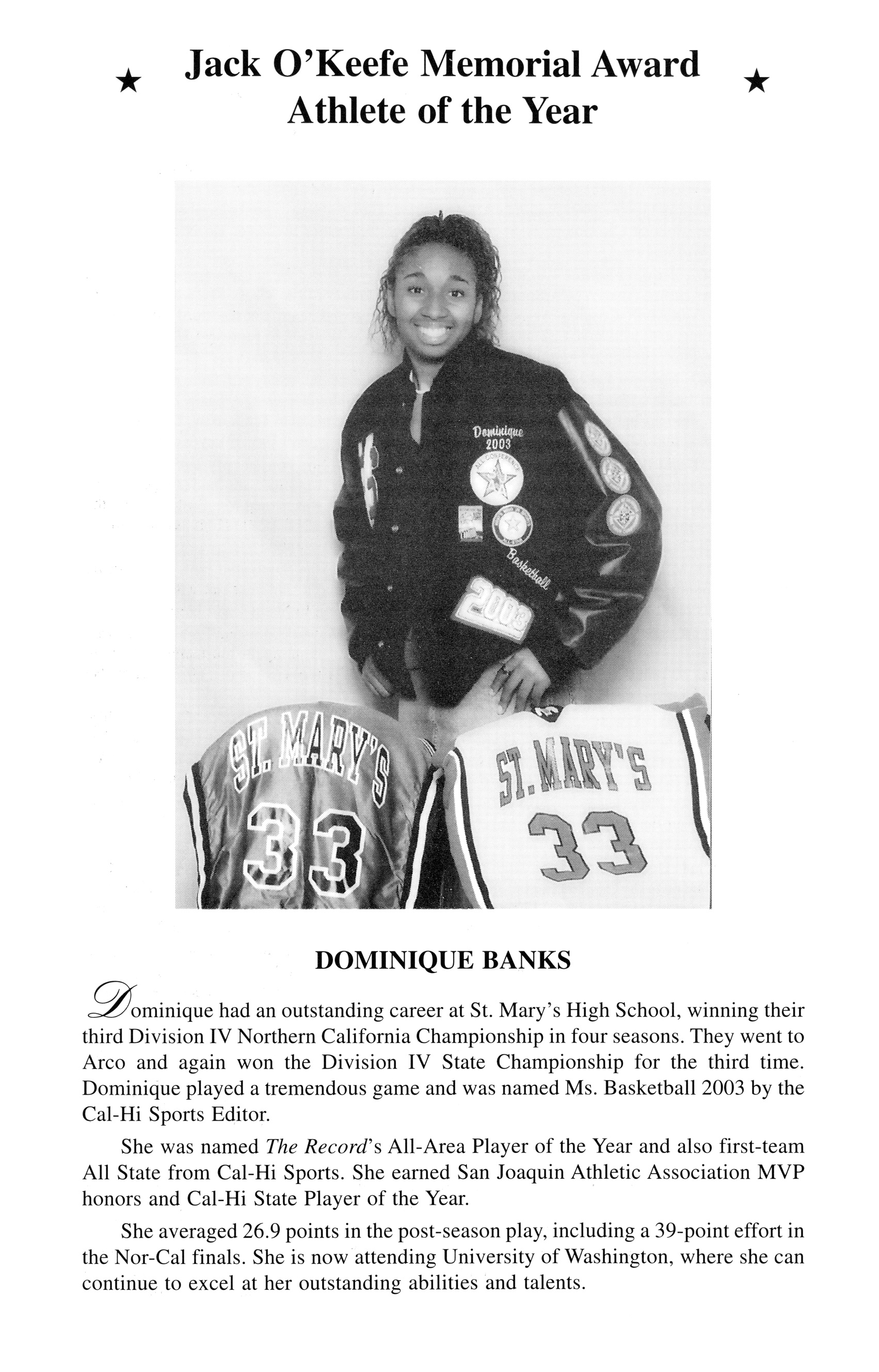

Dominique Banks – Stockton Athletic - Source stocktonhalloffame.com

The Big Short: How A Few Outsiders Took On The Banks And Won

The connection between "The Big Short: How A Few Outsiders Took On The Banks And Won" is the intricate relationship between the subprime mortgage market, the financial crisis of 2008, and the investors who profited from the collapse of the housing market. The subprime mortgage market was a major factor in the financial crisis, as it led to the collapse of several major financial institutions and the loss of trillions of dollars in wealth.

The investors in "The Big Short" were able to profit from the collapse of the housing market by betting against subprime mortgages. They correctly predicted that the housing market would collapse, and they made billions of dollars by investing in credit default swaps (CDSs) that were tied to subprime mortgages. The collapse of the housing market had a devastating impact on the global economy, but the investors in "The Big Short" were able to make a profit from it.

Lockscreens — I Took A Few Somewhat Aesthetic Pictures And Now in 2023 - Source www.pinterest.com

The connection between "The Big Short: How A Few Outsiders Took On The Banks And Won" is important because it shows how the financial crisis of 2008 was caused by the subprime mortgage market and the failure of the financial regulators to prevent it. It also shows how a few investors were able to profit from the collapse of the housing market by betting against subprime mortgages.

The practical significance of this understanding is that it can help us to prevent future financial crises. By understanding the causes of the financial crisis of 2008, we can take steps to prevent similar crises from happening in the future. We can also learn from the investors in "The Big Short" and use their strategies to protect ourselves from financial downturns.

| Cause | Effect |

|---|---|

| Subprime mortgage market | Financial crisis of 2008 |

| Failure of financial regulators | Collapse of several major financial institutions |

| Investors in "The Big Short" bet against subprime mortgages | Profit from the collapse of the housing market |

Conclusion

The connection between "The Big Short: How A Few Outsiders Took On The Banks And Won" is a complex and fascinating one. It is a story of greed, recklessness, and financial innovation. It is also a story of hope and redemption. The investors in "The Big Short" were able to profit from the collapse of the housing market, but they also helped to expose the flaws in the financial system. Their story is a reminder that even in the darkest of times, there is always hope.

The financial crisis of 2008 was a devastating event, but it also led to some important changes in the financial system. The Dodd-Frank Wall Street Reform and Consumer Protection Act was passed in 2010 in an effort to prevent future crises. The act includes a number of provisions that are designed to make the financial system safer and more transparent. These provisions include:

- Increased regulation of banks and other financial institutions

- Creation of the Consumer Financial Protection Bureau

- Restrictions on risky lending practices

- Increased transparency in the financial system

The Dodd-Frank Act is a major step forward in preventing future financial crises. However, it is important to remember that no law can completely eliminate the risk of financial crises. The best way to prevent future crises is to be aware of the risks and to take steps to protect ourselves from them.