Do you want to Transfer Bank Funds Securely And Efficiently: A Comprehensive Guide To Bank Transfers? Well, Here's the Guide!

Premium Vector | Fast money transfers around the world vector flat - Source www.freepik.com

Editor's Notes: "Transfer Bank Funds Securely And Efficiently: A Comprehensive Guide To Bank Transfers" have published today date. This is important to you because it provides a comprehensive overview of bank transfers, including how to initiate a transfer, the different types of transfers available, and the security measures in place to protect your funds.

To help you make the right decision, our team has put together this guide after doing some analysis and digging the information.

FAQs

This guide provides comprehensive information on securely and efficiently transferring funds between banks. Below are answers to frequently asked questions (FAQs) to address common queries and concerns.

Question 1: What are the essential steps to ensure a safe bank transfer?

To secure financial transfers, verify the recipient's account details meticulously, employ two-factor authentication, use a reputable and secure banking platform, avoid public Wi-Fi networks, and promptly report any anomalies to the bank.

Question 2: How can I avoid delays in bank transfers?

To prevent delays, initiate transfers during business hours, ensure the recipient's account details are accurate, avoid large transfers during peak times, and verify if any intermediary banks are involved, as they may cause additional processing time.

Question 3: Are there fees associated with bank transfers?

Bank transfer fees vary depending on factors such as the sending and receiving banks, the transfer method, and the amount being transferred. Some banks offer free transfers, while others may charge a flat fee or a percentage of the transfer amount.

Question 4: Can I cancel a bank transfer once it has been initiated?

In most cases, it is not possible to cancel a bank transfer once it has been processed. However, if the transfer has not yet been completed, contacting the sending bank promptly may allow for cancellation. The success of the cancellation depends on various factors, including the transfer status and the policies of the banks involved.

Question 5: What should I do if I encounter any issues with a bank transfer?

If you experience any issues or delays with a bank transfer, contact your bank immediately. Provide them with details of the transfer, including the transaction reference number, date, and amount. The bank will investigate the matter and provide assistance to resolve the issue.

Question 6: Are there any alternative methods for transferring funds securely?

In addition to traditional bank transfers, other secure methods of transferring funds include using online payment platforms, mobile banking apps, and wire transfer services. Each method has its advantages and fees, so choosing the most suitable option depends on individual needs and preferences.

![]()

Bank Transfer Vector Art, Icons, and Graphics for Free Download - Source www.vecteezy.com

Remember, staying informed and vigilant is crucial for safeguarding your financial transactions. By following these guidelines and seeking professional advice when necessary, you can ensure secure and efficient bank transfers.

Proceed to the next article section

Tips

To ensure secure and efficient bank transfers, follow these tips:

Tip 1: Verify Recipient Details

Before authorizing a transfer, thoroughly check the recipient's name, account number, and bank details. Mistakes can lead to delayed or lost funds.

Tip 2: Use Secure Channels

Initiate transfers through trusted platforms such as official bank websites or mobile apps. Avoid public Wi-Fi or shared computers for sensitive financial transactions.

Tip 3: Consider Transfer Fees

Be aware of any fees associated with transfers, including domestic and international charges. Compare different transfer options to minimize costs.

Tip 4: Set Up Two-Factor Authentication

Enable two-factor authentication (2FA) for added security. This requires additional verification, such as a code sent to your phone, before authorizing transactions.

Tip 5: Monitor Transactions Regularly

Review bank statements or set up account alerts to track transfers and identify any suspicious activity. Reporting unauthorized transactions promptly helps safeguard funds.

Tip 6: Use Transfer Bank Funds Securely And Efficiently: A Comprehensive Guide To Bank Transfers

Consult comprehensive guides or consult with financial professionals to gain in-depth knowledge about bank transfers and enhance security measures.

By following these tips, individuals can protect their financial assets and ensure seamless and secure bank transfers.

Summary: Secure bank transfers require meticulous attention to details, utilization of secure platforms, and implementation of appropriate security measures. Regular monitoring and education contribute to the safeguarding of funds.

Transfer Bank Funds Securely And Efficiently: A Comprehensive Guide To Bank Transfers

With the increasing reliance on electronic means for financial transactions, it is imperative to understand the nuances of bank transfers to ensure security and efficiency. This guide explores key aspects that enable individuals to successfully navigate the world of bank transfers.

By adhering to these key aspects, individuals can make informed and secure decisions when transferring bank funds. It is recommended to double-check recipient details, utilize strong authentication measures, and be cautious of unsolicited transfer requests. Furthermore, staying updated with the latest security measures and industry best practices ensures that bank transfers remain a safe and efficient means of financial transactions.

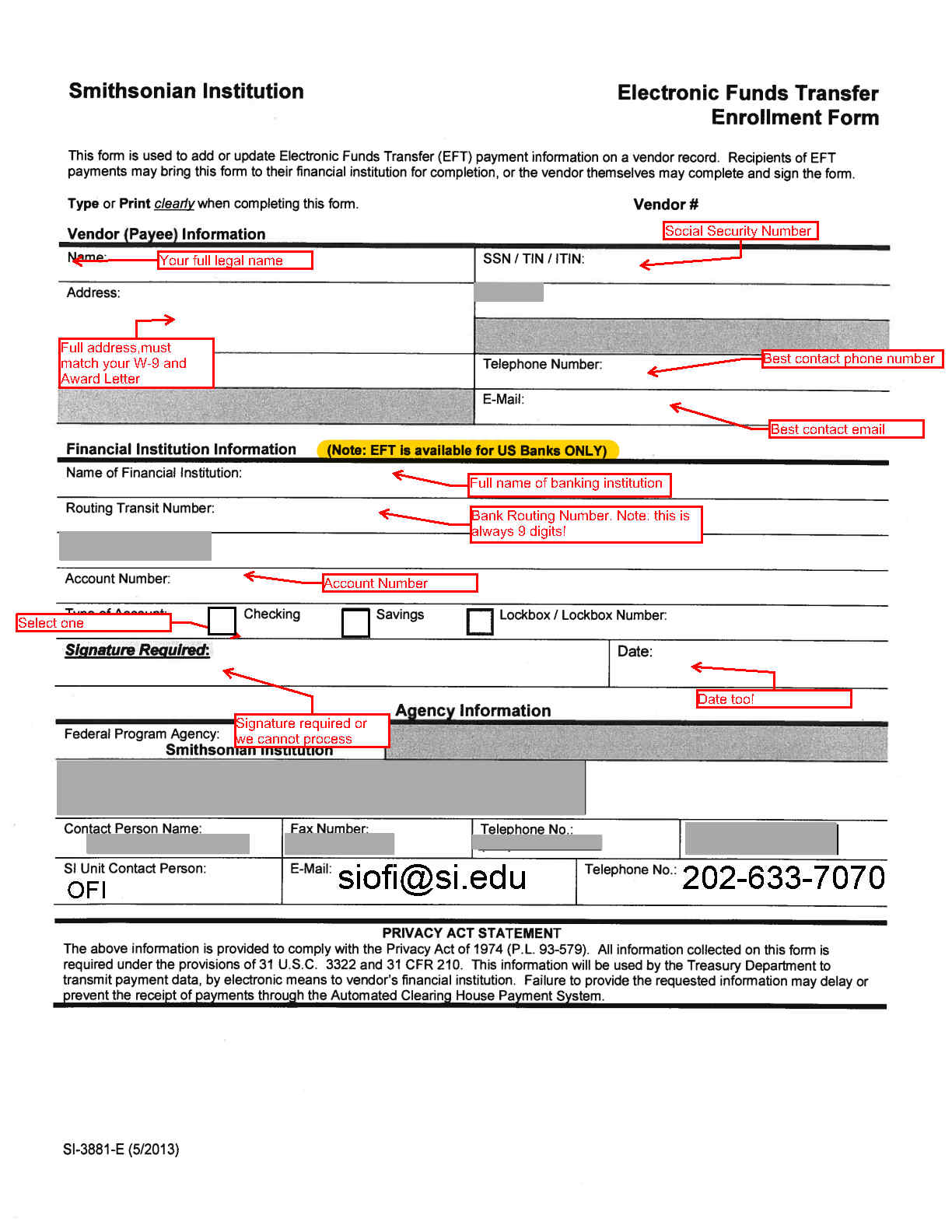

Electronic Funds Transfer Form | Office of Academic Appointments and - Source internships.si.edu

Transfer Bank Funds Securely And Efficiently: A Comprehensive Guide To Bank Transfers

Understanding bank transfers plays a key role in transferring funds securely and efficiently. This guide provides a comprehensive overview of the process, from choosing the right transfer method to protecting against fraud. By following the tips and strategies outlined here, individuals and businesses can ensure their financial transactions are handled safely and effectively.

The importance of bank transfers in today's globalized economy cannot be overstated. With the rise of e-commerce and digital payments, the ability to transfer funds quickly, securely, and cost-effectively has become essential. This guide serves as an invaluable resource for anyone seeking to navigate the complexities of bank transfers and optimize their financial operations.

The practical significance of this understanding extends to various aspects of personal finance and business management. Individuals can protect their hard-earned money from fraud and cyber threats by adhering to secure transfer practices. Businesses can streamline their financial operations, reduce costs, and enhance customer satisfaction by implementing efficient and reliable transfer mechanisms.

| Method | Security | Speed | Cost |

|---|---|---|---|

| Wire Transfer | High | Fast (1-2 days) | High |

| Automated Clearing House (ACH) | Medium | Slow (3-5 days) | Low |

| Real-Time Gross Settlement (RTGS) | Very High | Immediate | Very High |

| PayPal | Medium | Fast (1-2 days) | Variable |

| Venmo | Medium | Fast (1-2 days) | Low |