Treasury Letters Auction: Secure and Efficient Funding for Government Initiatives

Editor's Notes: "Treasury Letters Auction: Secure and Efficient Funding for Government Initiatives" published [Date]

In our effort to provide the most up-to-date and comprehensive Treasury Letters Auction: Secure And Efficient Funding For Government Initiatives guide, we've done some analysis, digging information, made our effort to put together this Treasury Letters Auction: Secure And Efficient Funding For Government Initiatives. We hope it will help you make the right decision.

Key differences or Key takeways

Treasury Letter Auctions are a form of government borrowing in which the government issues letters to investors, with a promise to repay the loan at a set interest rate over a certain period of time.

Transition to main article topics

Treasury Letter Auctions are an important tool for governments to raise funds for a variety of purposes, including:

- Funding government operations

- Financing infrastructure projects

- Providing financial assistance to businesses and individuals

Treasury Letter Auctions are generally considered to be a safe and efficient way for governments to raise funds, as they are backed by the full faith and credit of the government.

Treasury Letter Auctions are typically conducted through a competitive bidding process, in which investors submit bids to purchase the letters at the lowest possible interest rate.

The government then awards the letters to the investors who submit the lowest bids, and the proceeds from the sale of the letters are used to fund government initiatives.

Treasury Letter Auctions are an important tool for governments to raise funds, and they play a vital role in funding government operations and providing financial assistance to businesses and individuals.

APAC | Secure and Efficient Treasury Management: The Foundation for - Source www.fireblocks.com

FAQs

This Frequently Asked Questions (FAQs) section provides comprehensive information on Treasury Letters Auctions, a secure and efficient funding mechanism for government initiatives. It addresses common concerns, clarifies misconceptions, and enhances understanding of the auction process.

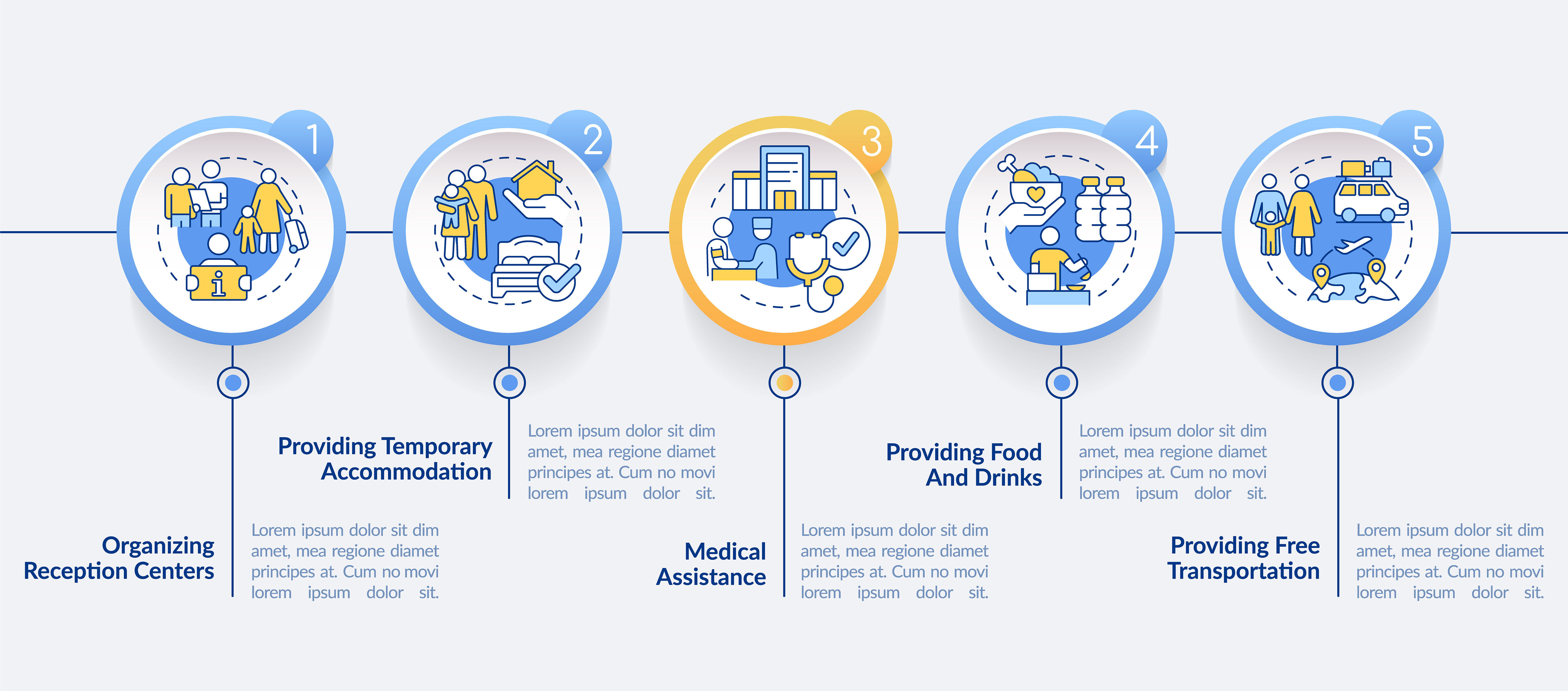

Government initiatives circle infographic template By bsd studio - Source thehungryjpeg.com

Question 1: What is a Treasury Letters Auction?

A Treasury Letters Auction is a bidding process where investors submit offers to purchase Treasury Letters, which represent short-term debt instruments issued by the government. These auctions provide funding for essential government initiatives and promote financial stability.

Question 2: Who can participate in the auctions?

Auctions are open to a wide range of participants, including banks, broker-dealers, investment firms, and other qualified institutional investors. Participation is subject to eligibility requirements and regulations set by the issuing authority.

Question 3: What are the key auction terms?

Auctions involve several key terms, such as auction date, settlement date, face value, and maturity date. These terms define the specific details of the auction and the obligations of both investors and the issuing authority.

Question 4: How are auction bids submitted?

Bids are typically submitted electronically through authorized auction platforms. Investors indicate the amount they are willing to invest and the price or yield they are offering. The auction process is designed to ensure fair and competitive bidding.

Question 5: How are winning bids determined?

Winning bids are determined based on the highest price offered or lowest yield demanded, subject to the conditions set by the issuing authority. The successful bids are allocated in a pre-determined manner, ensuring efficient funding and market stability.

Question 6: What are the benefits of participating in Treasury Letters Auctions?

Treasury Letters Auctions offer benefits such as secure investment opportunities, competitive returns, and support for government initiatives. Investors gain access to low-risk, short-term debt instruments while contributing to the nation's financial stability.

In summary, Treasury Letters Auctions are a critical mechanism for government funding and financial stability. By participating in these auctions, investors support essential initiatives and benefit from attractive investment opportunities. The auction process is secure, efficient, and subject to clear regulations, ensuring fair and competitive bidding practices.

For further information and participation guidelines, please refer to the official issuing authority's website or consult with authorized financial institutions.

Tips

Prepare yourself to get the most out of Treasury Letters Auctions by implementing the following tips into your strategy:

Tip 1: Know the Rules and Regulations

Make sure to familiarize yourself with the Treasury Letters Auction: Secure And Efficient Funding For Government Initiatives rules and regulations before participating. These guidelines will provide you with a clear understanding of the process, eligibility requirements, and bidding procedures.

Tip 2: Research Your Investment Options

Research different types of Treasury Letters available and assess their potential risks and returns. Consider your investment goals, risk tolerance, and time horizon to make informed decisions.

Tip 3: Determine Your Funding Needs

Calculate the amount of funding you require and determine the maturity date that aligns with your project or initiative timeline. This will help you select the appropriate Treasury Letters auction.

Tip 4: Plan Your Bid Carefully

Research market conditions and consult with financial advisors to determine competitive bids. Consider factors such as interest rates, inflation, and economic outlook.

Tip 5: Understand the Auction Process

Learn about the auction timeline, bidding procedures, and settlement process. This knowledge will allow you to participate effectively and maximize your chances of success.

Tip 6: Seek Professional Advice

If needed, consult with financial professionals or investment bankers who specialize in Treasury Letters auctions. Their expertise can provide valuable insights and guidance throughout the process.

Tip 7: Utilize Resources

Take advantage of available resources, such as the Treasury Department's website, industry publications, and financial news outlets. These sources can provide up-to-date information and analysis on Treasury Letters auctions.

Tip 8: Stay Informed

Monitor economic news and market trends that may impact the value of Treasury Letters. Stay informed about changes in interest rates, inflation, and government policies that could affect your investments.

By following these tips, you can increase your understanding of Treasury Letters auctions, make informed decisions, and maximize your chances of successful participation.

Treasury Letters Auction: Secure And Efficient Funding For Government Initiatives

Enhancing the resilience of government funding, the Treasury Letters Auction (TLA) emerges as a crucial mechanism. This innovative approach provides access to secure and efficient capital, bolstering financial stability and ensuring the availability of resources for government initiatives.

iCognition deploys secure EDRMS cloud for Treasury - iCognition - Source icognition.com.au

TLA's impact extends beyond financial markets, positively affecting government operations and public welfare. It enhances the transparency and accountability of public spending, supports infrastructure development, and promotes social programs that improve the lives of citizens. By ensuring secure and efficient funding for government initiatives, TLA plays a pivotal role in fostering economic prosperity and social well-being.

![]()

Government initiatives blue gradient concept icon Stock Vector Image - Source www.alamy.com

Treasury Letters Auction: Secure And Efficient Funding For Government Initiatives

Treasury Letters Auction plays a vital role in providing secure and efficient funding for government initiatives. It enables governments to borrow funds from investors through the auction of Treasury Letters, which are short-term debt instruments. These auctions ensure that governments can raise the necessary capital to finance their operations and public services without putting undue pressure on taxpayers. By facilitating the efficient allocation of funds, Treasury Letters Auctions contribute to the stability of the financial system and the broader economy.

![]()

Government initiatives concept icon. Federal regulation. Key supply - Source www.vecteezy.com

The importance of Treasury Letters Auctions is evident in real-life examples. In the United States, Treasury auctions have consistently attracted strong demand from investors, reflecting the high level of confidence in the government's ability to repay its debts. This demand has allowed the government to borrow at low interest rates, saving taxpayers billions of dollars in interest payments over time. Similarly, in the United Kingdom, Treasury auctions have provided a reliable source of funding for the government's infrastructure and public spending programs, contributing to the country's economic growth and development.

Understanding the connection between Treasury Letters Auctions and secure and efficient funding for government initiatives is crucial for several reasons. Firstly, it highlights the importance of a well-functioning financial system in supporting government operations and public services. Secondly, it demonstrates the role of investors in providing funding for government initiatives and the need for governments to maintain a strong credit rating to attract investment. Thirdly, it emphasizes the potential for Treasury Letters Auctions to contribute to economic stability and growth by ensuring the efficient allocation of funds and reducing the cost of borrowing for governments.

Conclusion

Treasury Letters Auctions are a key component of modern government finance, providing a secure and efficient means of funding government initiatives. By facilitating the auction of Treasury Letters, governments can raise capital from investors to finance their operations and public services without overburdening taxpayers. The success of Treasury Letters Auctions relies on a well-functioning financial system and investor confidence in the government's ability to repay its debts.

Understanding the connection between Treasury Letters Auctions and secure and efficient funding for government initiatives is essential for both governments and investors. For governments, it highlights the importance of maintaining a strong credit rating and developing a sound fiscal policy framework. For investors, it provides insights into the risks and returns associated with investing in government debt instruments and the role they can play in supporting government initiatives and economic growth.