Unlock Your Retirement Savings: A Comprehensive Guide To Premiepension

As we approach retirement age, it becomes increasingly important to ensure that we have made adequate financial preparation for our future. One valuable resource that many people neglect to consider is their Premiepension. This comprehensive guide will provide you with all the information you need to understand and unlock your Premiepension, helping you secure a more comfortable retirement.

12 Signs Your Retirement Savings are Just Not Enough - Source www.msn.com

Editor's Notes: "Unlock Your Retirement Savings: A Comprehensive Guide To Premiepension" has published on [today's date] to aware people that it’s never too early to increase knowledge about retirement savings. Use this guide to maximize your retirement savings and set yourself up for a comfortable future.

Through extensive research and analysis, we have compiled this comprehensive guide to provide you with the insights and strategies you need to make informed decisions about your Premiepension. We will cover everything from eligibility requirements to investment options, ensuring that you have all the knowledge necessary to unlock the full potential of this essential retirement savings tool.

Throughout this guide, we will highlight key differences and takeaways in an easy-to-understand table format. This will allow you to quickly identify the most important aspects of each topic and make informed comparisons.

In the following sections, we will cover the following topics in detail:

- What is Premiepension?

- Eligibility Requirements

- Investment Options

- Withdrawal Options

- Tax Implications

- Maximizing Your Premiepension

- Common Mistakes to Avoid

- Conclusion

FAQ

This FAQ section aims to provide comprehensive answers to common inquiries and address potential misconceptions regarding Premiepension, Sweden's premium pension system.

Question 1: What is Premiepension and how does it work?

Premiepension is a defined contribution pension system where individuals contribute a portion of their income to individual pension accounts. These contributions are invested in a variety of funds, and the returns on these investments determine the size of the pension upon retirement.

Is your savings enough for your retirement? - Kita Takaful - Source kitatakaful.com

Question 2: Who is eligible for Premiepension?

All individuals born in Sweden after 1954 or who have worked in Sweden for at least three years are eligible for Premiepension.

Question 3: How much can I contribute to Premiepension?

The maximum contribution to Premiepension is 2.5% of your income, up to a maximum of 6,800 SEK per year.

Question 4: How do I choose which funds to invest in?

You can choose from a wide range of funds offered by different providers. It is important to consider your risk tolerance and investment horizon when making your selections.

Question 5: When can I start receiving my Premiepension?

You can start receiving your Premiepension from the age of 65. However, you can choose to delay receiving your pension until a later age, which will result in a higher monthly payment.

Question 6: What happens to my Premiepension if I die before retirement?

If you die before retirement, your Premiepension will be passed on to your beneficiaries. You can designate beneficiaries when you set up your pension account.

Summary: Understanding Premiepension is crucial for planning your financial future. By actively managing your account, you can maximize your retirement savings and secure a comfortable retirement. For more information and personalized guidance, consult a financial advisor.

Transition:

Tips

When it comes to planning for retirement, every bit of savings can make a big difference. Unlock Your Retirement Savings: A Comprehensive Guide To Premiepension can help you get the most out of your retirement savings, with tips and tricks to maximize your contributions, reduce fees, and invest wisely.

Tip 1: Make regular contributions.

The more you contribute to your retirement savings account, the more money you'll have when you retire. Even if you can only contribute a small amount each month, it will add up over time. And, if your employer offers a matching contribution, be sure to take advantage of it.

Tip 2: Choose the right investments.

The investments you choose for your retirement savings account will have a big impact on how much money you have when you retire. It's important to choose investments that are right for your age, risk tolerance, and investment goals.

Tip 3: Rebalance your portfolio regularly.

As you get closer to retirement, you'll want to rebalance your portfolio to reduce risk. This means selling some of your stocks and bonds, and investing the proceeds in safer investments, such as certificates of deposit or money market accounts.

Tip 4: Take advantage of tax breaks.

There are a number of tax breaks available to help you save for retirement. Be sure to take advantage of these tax breaks to reduce the amount of taxes you pay on your retirement savings.

Tip 5: Avoid unnecessary fees.

Some retirement savings accounts have high fees that can eat into your savings over time. Be sure to compare the fees of different accounts before you choose one.

By following these tips, you can help ensure that you have a comfortable retirement.

Unlock Your Retirement Savings: A Comprehensive Guide To Premiepension

Navigating the intricacies of retirement savings can be daunting, and Premiepension, Sweden's premium pension system, is no exception. This guide unpacks six essential aspects to help you unlock your retirement savings and secure your financial future.

- Understand Your Options: Explore the different funds and investment strategies available within Premiepension.

- Maximize Tax Benefits: Leverage the tax advantages offered by Premiepension to grow your savings.

- Manage Risk: Tailor your investment strategy to your risk tolerance and retirement goals.

- Long-Term Perspective: Invest with a long-term horizon, allowing compound interest to work in your favor.

- Regular Monitoring: Track your investments and adjust your strategy as needed to meet changing market conditions.

- Professional Advice: Consider seeking guidance from a financial advisor to optimize your Premiepension strategy.

Understanding these key aspects is crucial for unlocking the full potential of Premiepension. By diversifying your investments, taking advantage of tax benefits, and adopting a long-term perspective, you can secure a comfortable retirement and achieve financial freedom. Regular monitoring and professional advice can further enhance your strategy, ensuring alignment with your individual circumstances and goals.

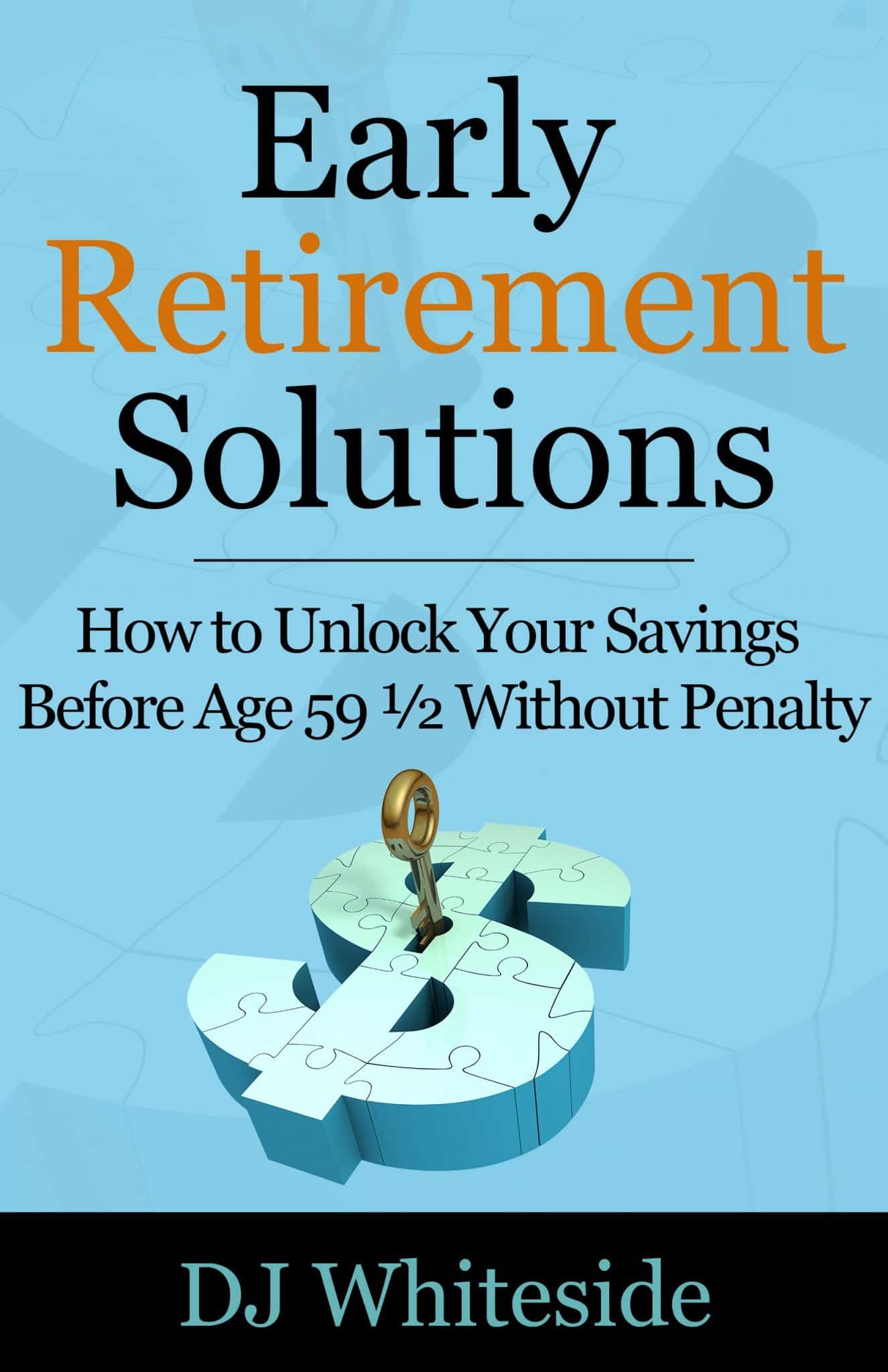

Unlock Your Retirement Savings Before Age 59-1/2 to Retire Early - Source www.mymoneydesign.com

Unlock Your Retirement Savings: A Comprehensive Guide To Premiepension

Premiepension is a Swedish premium pension system that provides a framework for individuals to save for their retirement. Understanding the connection between "Unlocking Your Retirement Savings" and Premiepension is crucial. Premiepension enables individuals to take control of their retirement savings, allowing them to make informed decisions about how to maximize their retirement income. By providing a comprehensive guide to Premiepension, individuals can unlock the potential of their retirement savings, ensuring financial security in their later years.

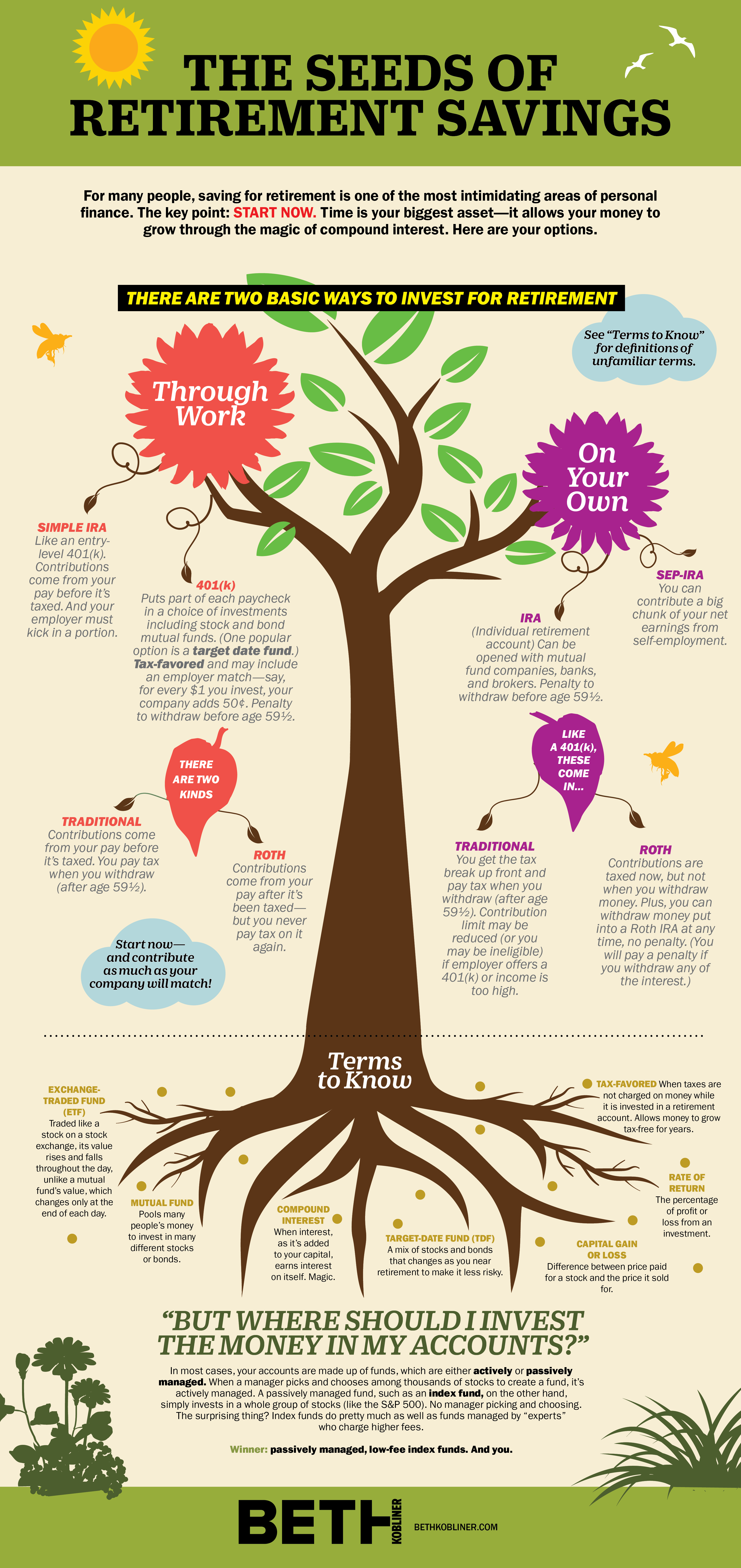

How to invest and grow your retirement savings - Source bethkobliner.com

One of the key benefits of Premiepension is its flexibility. Individuals have the freedom to choose how their savings are invested, tailoring their portfolio to align with their risk tolerance and financial goals. This level of control empowers individuals to optimize their retirement savings, increasing the likelihood of achieving their desired retirement lifestyle.

Furthermore, Premiepension encourages long-term saving. By starting early and contributing regularly, individuals can benefit from the power of compounding, allowing their savings to grow exponentially over time. This long-term perspective helps individuals build a substantial retirement nest egg, providing them with financial stability during their golden years.

Understanding the connection between "Unlock Your Retirement Savings" and Premiepension is essential for individuals seeking to secure their financial future. Premiepension offers a valuable framework for retirement saving, empowering individuals to take control of their finances and make informed decisions. By embracing the principles of Premiepension, individuals can unlock the potential of their retirement savings, ensuring a comfortable and fulfilling retirement.

| Key Insight | Significance |

|---|---|

| Premiepension empowers individuals to control their retirement savings | Decision-making autonomy optimizes retirement outcomes |

| Flexibility in investment choices | Tailoring portfolios to individual risk tolerance and goals |

| Long-term saving and compounding | Accelerated wealth growth leading to a robust retirement nest egg |

Conclusion

Premiepension is a powerful tool that can help individuals unlock their retirement savings and achieve financial security in their later years. By providing a framework for long-term saving and empowering individuals with investment control, Premiepension sets the foundation for a comfortable and fulfilling retirement.

The key to successful retirement planning is to start early and stay committed. The sooner individuals begin contributing to Premiepension, the more time their savings have to grow and compound. Additionally, regularly reviewing and adjusting their investment strategy can help ensure their portfolio remains aligned with their changing circumstances and goals.

By embracing the principles of Premiepension, individuals can take proactive steps towards securing their financial future. With careful planning and a commitment to long-term saving, Premiepension can help individuals unlock their retirement dreams and enjoy a comfortable and fulfilling retirement.