Understanding the impact of market holidays on your trading strategies is crucial for any investor or trader. To help you make informed decisions, we've compiled this comprehensive guide, providing insights and strategies to optimize your trades during holiday periods.

| Feature | Benefits |

|---|---|

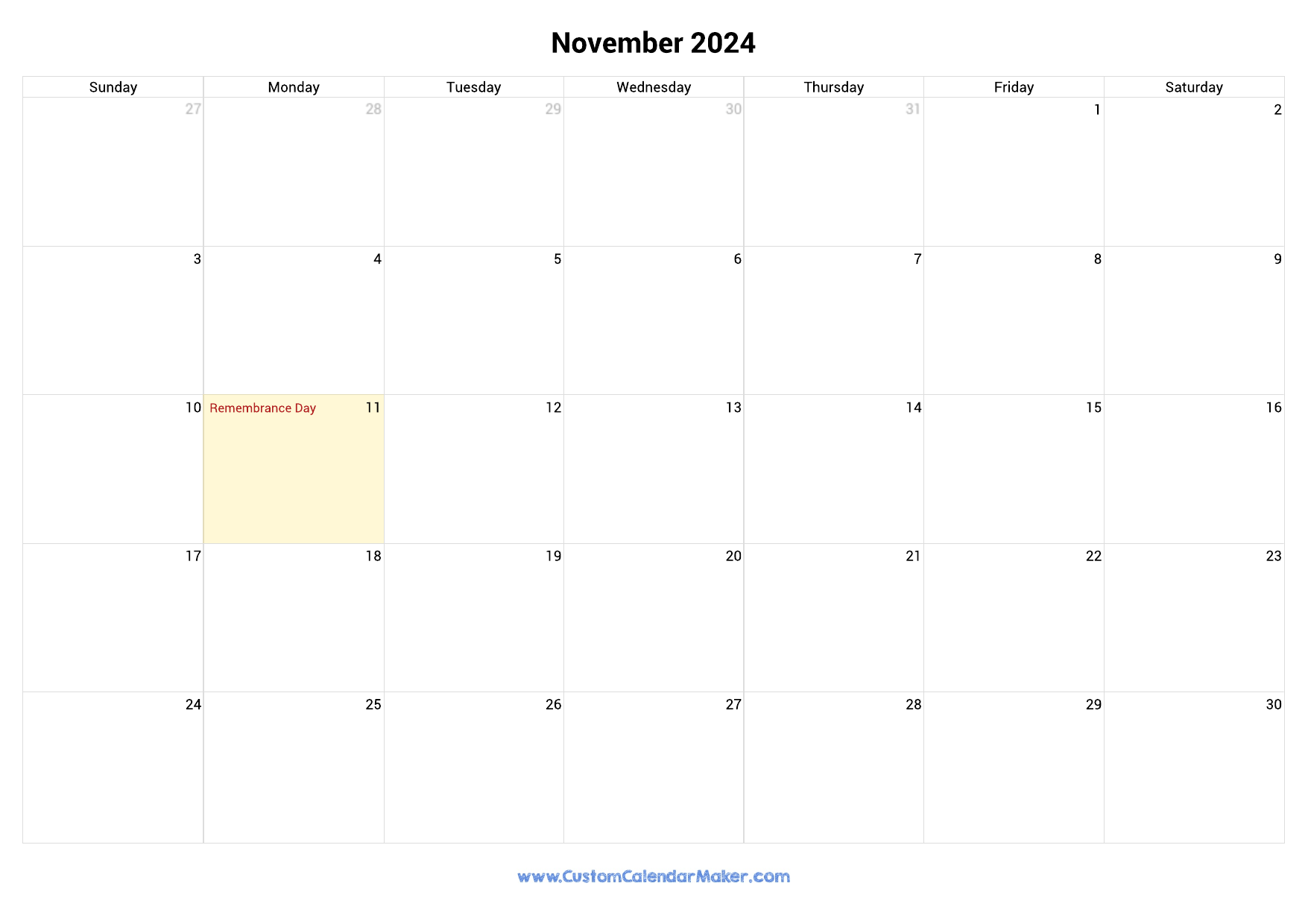

| Holiday Calendar | Stay informed about upcoming market closures and avoid unexpected disruptions |

| Market Behavior Analysis | Understand historical trends and market reactions during holidays to adjust your strategies |

| Trading Volume and Volatility | Anticipate lower trading volumes and increased volatility, leading to wider spreads and potential slippage |

| Advance Planning | Adjust positions and execute trades in advance to minimize the impact of market closures |

| Risk Management | Implement risk mitigation strategies to protect your portfolio during volatile holiday periods |

FAQ

This section addresses some frequently asked questions regarding US market holidays and their implications for trading and investment strategies.

Market Holidays 2024 Canada Pdf Download - Olia Tildie - Source anabelvmollie.pages.dev

Question 1: When are the major US market holidays?

The major US market holidays include New Year's Day, Martin Luther King Jr. Day, Presidents' Day, Good Friday, Memorial Day, Juneteenth National Independence Day, Independence Day, Labor Day, Columbus Day, Veterans Day, Thanksgiving Day, and Christmas Day.

Question 2: Are the markets closed on all major holidays?

Yes, all major US stock exchanges, including the New York Stock Exchange (NYSE) and Nasdaq, are closed on all major holidays.

Question 3: How do market holidays affect trading?

Market holidays can significantly impact trading activity. On holiday weeks, trading volumes tend to be lower, and the markets may experience increased volatility and price fluctuations.

Question 4: How can I plan for market holidays when making investment decisions?

To plan for market holidays, consider the following:

- Review the market holiday schedule and identify the dates when the markets will be closed.

- Adjust trading strategies and positions accordingly, such as closing open positions or placing stop-loss orders.

- Be cautious of potential price movements and increased volatility during holiday weeks.

Question 5: Are there any opportunities associated with market holidays?

While market holidays can present challenges, they can also provide opportunities. For example, some traders may use holiday periods to research and analyze market trends or make adjustments to investment portfolios.

Question 6: How can I stay informed about market closures and other important market events?

To stay informed, it is recommended to subscribe to financial news and market updates from reputable sources. Additionally, checking the websites of major financial institutions and exchanges for holiday announcements is essential.

Understanding the impact of US market holidays is crucial for successful trading and investment planning. By considering the factors outlined above, participants can adjust their strategies and optimize returns during holiday periods.

Proceed to the next section for further insights on maximizing returns during market holidays.

Tips

The US market follows a set schedule of holidays when trading is closed. Being aware of these holidays can help investors plan their trades and maximize returns.

Tip 1: Check the market calendar regularly to stay informed about upcoming holidays.

Tip 2: Consider the impact of holidays on market volatility. Holidays can lead to increased volatility, which can present both opportunities and risks.

Tip 3: Adjust trading strategies accordingly. For example, investors may choose to reduce their positions or avoid trading altogether during holiday periods.

Tip 4: Be aware of the holiday schedule when placing orders. Orders placed on a holiday may not be executed until the market reopens.

Tip 5: Monitor market news and announcements during holiday periods. Important news events can still occur during holidays, which can impact the market upon reopening.

For a more comprehensive guide to US market holidays, refer to Comprehensive Guide To US Market Holidays: Plan Your Trades And Maximize Returns.

By following these tips, investors can stay informed about market holidays and make well-informed trading decisions.

Comprehensive Guide To US Market Holidays: Plan Your Trades And Maximize Returns

US market holidays offer unique trading opportunities and challenges. A comprehensive understanding of these holidays is essential for successful trading. This guide explores six key aspects to consider.

- Historical Impact: Study market behavior during past holidays to identify patterns.

- Market Closure: Determine exact holiday hours to avoid missed trades or losses.

- Volatility: Anticipate increased price fluctuations around holidays due to reduced liquidity.

- Risk Management: Adjust trading strategies to minimize risks associated with market volatility.

- Trading Strategies: Explore various trading strategies suitable for specific holidays, such as scalping or breakout strategies.

- Calendar Analysis: Create a comprehensive calendar of upcoming US market holidays to plan trading activities accordingly.

By considering these key aspects, traders can gain a significant advantage in planning their trades during US market holidays. Understanding historical patterns, market closure times, volatility, risk management techniques, trading strategies, and calendar analysis empowers traders to make informed decisions, maximize returns, and minimize losses.

Public Holidays In December 2024 - Essa Ofella - Source myrtlewbobbye.pages.dev

Stock Market Holidays 2024 Usa Today - Estele Tamarah - Source shalnawlinda.pages.dev

Comprehensive Guide To US Market Holidays: Plan Your Trades And Maximize Returns

This guide provides comprehensive coverage of US market holidays, enabling traders to plan their trades effectively and maximize their returns. Understanding the impact of holidays on market activity is crucial for successful trading.

During holidays, market liquidity decreases, and volatility can increase due to the absence of major market participants. This can lead to wider bid-ask spreads and potentially less favorable execution prices. By being aware of upcoming holidays, traders can adjust their trading strategies accordingly, such as reducing their trading volume or closing positions before the holiday.

The Chosen 2024 Calendar With Holidays - Lanni Modesta - Source darrylvleontyne.pages.dev

Moreover, holidays can indicate periods of reduced trading activity, providing opportunities for traders to re-evaluate their strategies, conduct research, or take a break from trading.

In conclusion, understanding the impact of US market holidays is an essential aspect of successful trading. By planning trades around these events, traders can minimize risks, optimize execution, and maximize returns.

Conclusion

In summary, understanding the impact of US market holidays is crucial for traders to plan their trades effectively and maximize returns. By being aware of upcoming holidays, traders can adjust their trading strategies, reduce risks, optimize execution, and take advantage of opportunities.

Traders should regularly consult reliable sources for the most up-to-date information on US market holidays to stay informed and make informed trading decisions.