CPF Singapore Retirement Reforms 2025: Enhancements To Secure Your Retirement Future

The Florida Retirement System’s Future Looks Bleak Without Reforms - Source reason.org

Editor's Notes: "CPF Singapore Retirement Reforms 2025: Enhancements To Secure Your Retirement Future" was published on June 12, 2023. CPF Singapore Retirement Reforms 2025: Enhancements To Secure Your Retirement Future is an essential read for anyone who wants to make sure they are financially secure in their retirement. It provides a comprehensive overview of the key changes to the Central Provident Fund (CPF) system in Singapore, and explains how these changes will impact your retirement savings.

Our team has done some analysis, digging information, research, and made CPF Singapore Retirement Reforms 2025: Enhancements To Secure Your Retirement Future. We put together this CPF Singapore Retirement Reforms 2025: Enhancements To Secure Your Retirement Future guide to help you make the right decision.

Key differences or Key takeaways:

| Old System | New System | |

|---|---|---|

| Retirement Age | 62 | 65 |

| Minimum Sum | $155,000 | $196,000 |

| CPF Interest Rates | 2.5% | 3% |

Transition to main article topics

FAQ

The CPF Singapore Retirement Reforms 2025 aim to enhance retirement security for Singaporeans by introducing various enhancements to the CPF system. These reforms are designed to ensure that individuals accumulate sufficient retirement savings and have a more comfortable retirement. This FAQ section addresses common questions and misconceptions about the reforms.

Question 1: What are the key changes introduced by the CPF Retirement Reforms 2025?

The reforms enhance three key aspects of the CPF system: contribution rates, CPF Minimum Sum, and CPF Life payouts. Contribution rates will be gradually increased for younger workers, the CPF Minimum Sum will be raised to ensure adequate retirement savings, and CPF Life payouts will be enhanced to provide higher monthly payouts during retirement.

Question 2: How will the contribution rate changes affect me?

The contribution rate changes will be implemented gradually over several years. Employees and employers will contribute a higher percentage of their salaries to CPF, resulting in increased CPF savings. These higher contributions will help individuals accumulate a larger retirement nest egg.

Question 3: What is the impact of the CPF Minimum Sum increase?

The increase in CPF Minimum Sum ensures that individuals have sufficient savings to meet their basic retirement needs. The higher Minimum Sum will help to prevent individuals from outliving their retirement savings and facing financial difficulties in their later years.

Question 4: How do the CPF Life payout enhancements benefit me?

The CPF Life payout enhancements provide higher monthly payouts to retirees. The enhancements are designed to ensure that individuals receive a more comfortable and sustainable income during retirement. Retirees can expect to receive higher payouts than under the current CPF Life scheme.

Question 5: What should I do to prepare for the CPF Retirement Reforms 2025?

Individuals should review their retirement plans and consider increasing their CPF contributions voluntarily. They should also explore other retirement planning options, such as investing in CPF-approved investment products or purchasing annuities. By taking proactive steps, individuals can supplement their CPF savings and enhance their retirement security.

Question 6: Where can I find more information about the CPF Retirement Reforms 2025?

Individuals can refer to the CPF website or visit CPF service centres for more information about the CPF Retirement Reforms 2025. Financial advisors can also provide professional advice and guidance on retirement planning.

Tips

Singapore's Central Provident Fund (CPF) will implement enhancements in 2025 to further support individuals in securing their retirement. Here are key tips to consider:

Tip 1: Understand the New CPF Contribution Rates

From 2025, CPF contribution rates will increase gradually for younger members. This aims to ensure they accumulate sufficient CPF savings for retirement while maintaining a balance with their current needs.

Tip 2: Opt for the Enhanced CPF Interest Rates

Members with lower CPF balances can choose to earn enhanced CPF interest rates on their Ordinary Account (OA) savings. This helps them grow their retirement savings more effectively.

Tip 3: Utilize the Silver Support Scheme

The Silver Support Scheme provides additional CPF top-ups for lower-income seniors. These top-ups enhance their retirement savings and help them meet their basic needs.

Tip 4: Contribute Voluntarily to Your CPF Account

Individuals can make voluntary CPF contributions to supplement their retirement savings. These contributions qualify for tax relief and can help accelerate the growth of your CPF balance.

Tip 5: Explore CPF Investment Schemes

Consider investing your CPF savings in low-risk investment schemes within the CPF Investment Scheme (CPFIS) framework to potentially boost your retirement income.

By following these tips, individuals can make informed decisions and take advantage of the CPF enhancements to secure their retirement future. For more details, refer to CPF Singapore Retirement Reforms 2025: Enhancements To Secure Your Retirement Future.

CPF Singapore Retirement Reforms 2025: Enhancements To Secure Your Retirement Future

The CPF Singapore Retirement Reforms 2025 aim to ensure that Singaporeans have a secure retirement future. These reforms include enhancements in various areas, each playing a crucial role in safeguarding financial stability in retirement.

- Contribution Rate Increase: Gradual increase in CPF contribution rates to enhance retirement savings.

- Enhanced CPF Lifelong Income For The Elderly (CPF LIFE): New payout options and higher payouts to provide greater retirement income.

- Flexible Retirement Age: Gradual increase in retirement age to allow individuals to work longer and accumulate more savings.

- Silver Support Scheme: Enhanced support for low-income seniors to supplement their retirement income.

- Caregiving Leave: Leave entitlement for employees to care for elderly family members, fostering a cohesive society.

- Enhanced Retirement Planning: CPF members to receive personalized retirement estimates and financial planning tools.

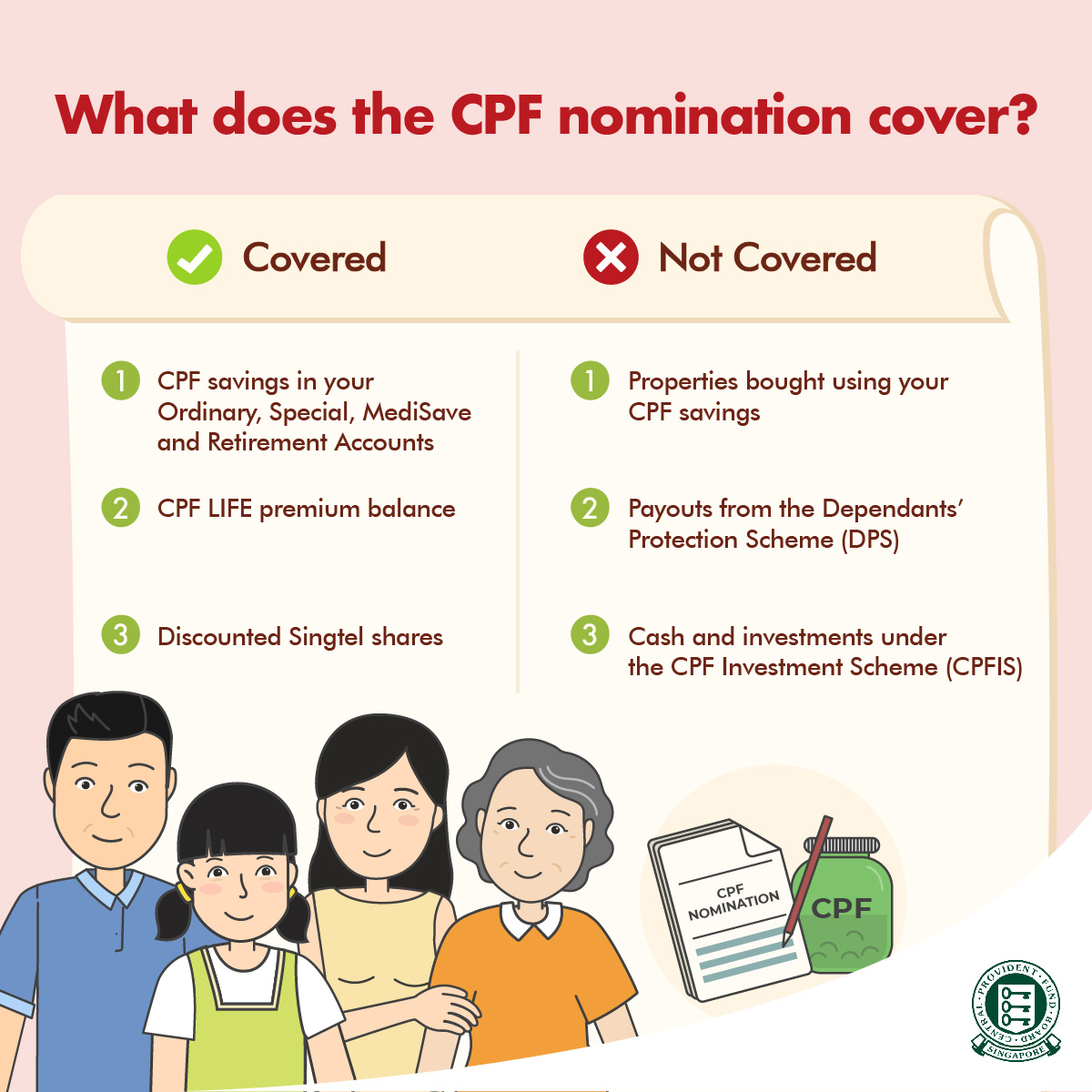

CPFB | What does your CPF nomination cover? - Source www.cpf.gov.sg

These measures collectively aim to address the challenges of an aging population and increasing healthcare costs. By increasing retirement savings, providing sustainable income streams, and empowering individuals with financial planning tools, the CPF Singapore Retirement Reforms 2025 strive to create a robust and secure retirement future for Singaporeans.

CPF Singapore Retirement Reforms 2025: Enhancements To Secure Your Retirement Future

The CPF Retirement Reforms 2025 proposed by the Singapore government aim to enhance the Central Provident Fund (CPF) system and ensure the financial security of Singaporeans during their retirement years. These reforms are crucial as they address the changing demographics, increasing life expectancy, and the need for a more robust retirement system. The reforms focus on increasing retirement savings, providing flexibility in accessing retirement funds, and enhancing support for vulnerable groups.

Secure Your Retirement Savings: The Three-Bucket Strategy - Source www.captrustadvice.com

One key reform is raising the Retirement Sum to S$300,000 for Singaporeans born in 1958 and later. This increased sum will provide higher retirement savings for individuals, ensuring a more comfortable retirement lifestyle. Additionally, the CPF Minimum Sum, which is the amount that must be set aside for retirement, has been enhanced to $181,000 for those reaching age 55 in 2023 and later. This ensures that individuals have a sufficient retirement nest egg.

Another important aspect of the reforms is the introduction of the CPF LIFE Retirement Sum Topping-Up Scheme. This scheme allows individuals to voluntarily top up their CPF Retirement Account to enhance their retirement income. By utilizing this scheme, individuals can increase their future retirement payouts and supplement their savings.

The CPF Retirement Reforms 2025 also recognize the need for flexibility in accessing retirement funds. The changes include the introduction of a new CPF Retirement Account and a CPF Retirement Income Account. The CPF Retirement Account will allow individuals to draw down their retirement savings gradually, while the CPF Retirement Income Account will provide regular monthly payouts for life. This flexibility gives individuals more control over how and when they access their retirement funds.

Furthermore, the reforms emphasize enhancing support for vulnerable groups. The government has introduced the Silver Support Scheme, which provides additional CPF top-ups for low-income elderly Singaporeans. This scheme ensures that vulnerable individuals have a basic level of retirement income.

The CPF Retirement Reforms 2025 are a comprehensive set of enhancements that aim to strengthen the retirement security of Singaporeans. By increasing retirement savings, providing flexibility in accessing funds, and supporting vulnerable groups, the reforms ensure that individuals can enjoy a financially secure retirement future.