Unlock Your Financial Health: Improve Your Credit Score For A Brighter Future

Editor's Notes: "Unlock Your Financial Health: Improve Your Credit Score For A Brighter Future" have published today date is an easy-to-follow guide that can help our target audience make the right decision.

After doing some analysis, digging around, and making some calls, we put together this Unlock Your Financial Health: Improve Your Credit Score For A Brighter Future guide to help you make the right decision.

| Feature | Description |

|---|---|

| Article Type | Guide |

| Target Audience | Anyone can who wants to improve their understanding of how the Unlock Your Financial Health: Improve Your Credit Score For A Brighter Future work. |

| Key Points |

- Key point 1:

- Key point 2:

- Key point 3:

- Key point 4:

- Key point 5:

|

| Estimated Time to Complete | 10 minutes |

| Disclaimer | This article does not provide financial advice. |

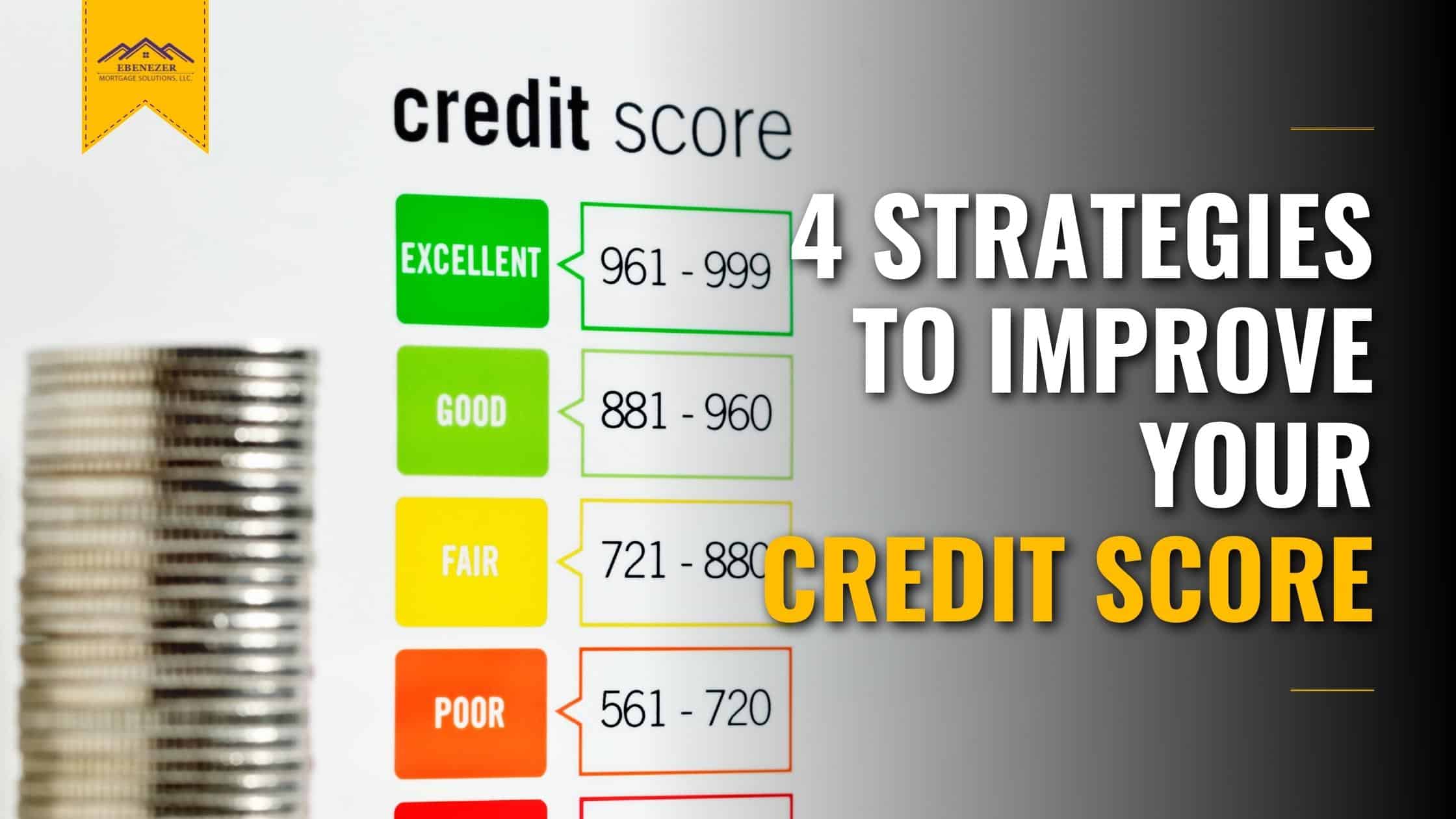

4 Strategies To Improve Your Credit Score - Ebenezer Home Loans - Source www.ebenezermortgage.com

FAQ

This set of frequently asked questions (FAQs) provides valuable insights into the crucial topic of improving your credit score. Each question delves into common concerns and misconceptions, offering expert guidance on the path to financial well-being.

Question 1: How does a low credit score impact my life?

A low credit score can present significant challenges, potentially resulting in:

- Higher interest rates on loans and credit cards

- Difficulty obtaining loans, mortgages, or other forms of credit

- Insurance policies with higher premiums

- Limited employment opportunities or advanced career prospects

Question 2: Can I improve my credit score quickly?

While rapid credit score improvement can be challenging, responsible financial management over time can yield positive results. Consistent efforts, including timely bill payments, maintaining a low credit utilization ratio, and disputing any errors on your credit report, can gradually elevate your score.

Question 3: What is a good credit score?

Generally, credit scores fall within a range of 300 to 850. Scores above 700 are considered good, with scores above 800 indicating exceptional creditworthiness. Maintaining a high credit score opens doors to favorable interest rates, loan terms, and other financial opportunities.

Question 4: How often should I check my credit report?

Regularly monitoring your credit reports from the three major credit bureaus (Equifax, Experian, and TransUnion) is crucial. You are entitled to one free credit report from each bureau annually. By reviewing your report thoroughly, you can identify and address any inaccuracies or potential fraudulent activity.

Question 5: What is a secured credit card, and how can it help me?

A secured credit card requires a cash deposit as collateral. It is designed to help individuals with limited or damaged credit history establish or rebuild their credit. Regular and responsible use of a secured credit card can demonstrate creditworthiness, gradually improving your credit score.

Question 6: Is it possible to repair my credit after bankruptcy?

Recovering from bankruptcy takes time and effort, but it is possible to rebuild your credit. Focus on consistently paying your bills on time, maintaining a low credit utilization ratio, and avoiding new debt. Over time, responsible financial habits will gradually restore your credit score.

Understanding these FAQs empowers you with the knowledge to navigate the complexities of credit scores and make informed financial decisions. By taking proactive steps to improve your credit score, you unlock opportunities for financial success and a brighter future.

Explore the next section to delve deeper into the strategies and insights for improving your credit score.

Tips to Improve Your Credit Score

A strong credit score is vital for financial health. It can impact everything from Unlock Your Financial Health: Improve Your Credit Score For A Brighter Future loan approvals and interest rates to insurance premiums and even job opportunities. Here's how to embark on the journey to a brighter financial future:

Tip 1: Pay Bills on Time

Payment history is a significant factor in credit scoring. Consistently making timely payments demonstrates financial responsibility and improves your score.

Tip 2: Keep Credit Utilization Low

Credit utilization, the amount of credit you use compared to your available limit, influences your score. Aim to keep utilization below 30% to signal responsible credit management.

Tip 3: Avoid Hard Inquiries

Hard inquiries, such as those triggered by loan applications, can temporarily lower your score. Limit unnecessary inquiries and consider prequalification options to minimize the impact.

Tip 4: Build a Credit History

Establish and maintain a credit history by using credit cards or taking out a small loan. Regular use and timely payments demonstrate creditworthiness and contribute to a positive score.

Tip 5: Dispute Errors

Review your credit reports regularly and dispute any errors. Inaccurate or outdated information can negatively impact your score.

By following these tips, you can gradually improve your credit score and unlock financial opportunities. Remember, building a strong credit history takes time and consistency, but the rewards are well worth the effort.

Unlock Your Financial Health: Improve Your Credit Score for a Brighter Future

While the concept of financial well-being might be broad, focusing on essential aspects of credit health can provide a strong basis for your financial journey. A good credit score can open up numerous opportunities and make it easier to achieve financial goals. Here are some key aspects to consider:

- Payment History: Consistent and timely payments build a positive track record.

- Credit Utilization: Keeping balances low relative to credit limits shows responsible use.

- Credit Age: Length of credit history can positively impact your score, so avoid closing old accounts.

- New Credit: Applying for too many new credit lines in a short period can raise red flags.

- Credit Mix: Having a mix of credit types, such as revolving and installment accounts, can demonstrate financial stability.

- Credit Monitoring: Regularly review your credit report for errors or potential fraud.

By focusing on these factors, you can establish and maintain a healthy credit score. This can lead to lower interest rates on loans, higher credit limits, and better insurance premiums. It can also open doors to financial products and services that can help you reach your long-term financial goals. Remember, building a strong credit score is an ongoing process that requires consistent effort and discipline, but the rewards can be significant.

How to Improve Your Credit Score | Blog - Source www.yoursiliconvalleylife.com

Unlock Your Financial Health: Improve Your Credit Score For A Brighter Future

A credit score is a crucial measure of financial well-being, acting as a gateway to accessing financial products and services. A healthier credit score grants access to lower interest rates on loans, higher credit limits, and favorable insurance premiums. Conversely, a poor credit score can lead to higher interest rates, limited credit options, and difficulty qualifying for certain financial products.

How to Improve Your Credit Score After Late Payments - Source thefrugalcreditnista.com

Therefore, maintaining a healthy credit score is essential for achieving financial stability and future prosperity. By understanding the factors that affect your credit score, such as payment history, credit utilization, and credit inquiries, you can actively manage your credit habits and improve your score over time.

Improving your credit score is not an overnight process. It requires consistent effort and responsible financial management. By regularly monitoring your credit report, resolving any inaccuracies, and proactively building your credit through responsible credit use, you can unlock your financial health and secure a brighter financial future.

For further Insights:

| Reason | Impact |

|---|---|

| On-time payments | Consistency in making payments on time is the most important factor affecting your credit score. |

| Low credit utilization | Keeping your credit utilization ratio low, below 30%, indicates responsible use of credit. |

| Length of credit history | A longer credit history builds your credibility and shows a consistent pattern of responsible credit management. |

Conclusion

In today's financial landscape, a healthy credit score is paramount for securing financial stability and accessing financial opportunities. By understanding the connection between positive credit habits and a brighter financial future, individuals can take proactive steps to improve their credit score and unlock their financial health. Consistent effort, responsible financial management, and a commitment to maintaining a healthy credit profile are key to financial success.

Unlocking your financial health through credit score improvement is an empowering journey that requires dedication but ultimately leads to greater financial freedom, opportunities, and peace of mind.